Make user insights your strategic asset

Advance your organization’s research practice and business impact with our new research maturity model—built on data from 500+ research, design, and product professionals.

From ad-hoc insights to organization-wide learning

As product development accelerates, the future belongs to organizations that learn as they build—putting user insights at the center of every decision.

Maze surveyed over 500 researchers, designers, and product managers from 475 organizations to explore the factors that promote an insights-led culture and their impact on business performance.

The resulting Research Maturity Model offers an actionable framework for evolving research from isolated efforts into a scalable system that supports better decision-making.

- Discover the five levels of research maturity and access actionable resources to advance the role of user insights in your organization

- Uncover what sets insights-led organizations apart—and identify the key areas to scale your research practice, maximize ROI, and build a strong case for future investment

- Benchmark your research practices against industry standards—broken down by company size, industry, and geographical region

- Empower everyone to make customer-centric decisions—from product teams all the way to the C-suite

2.3x

better business outcomes

Organizations with mature research practices achieve 4.3x faster time-to-market and 4.2x increased revenue.

1.8x

more likely to run research frequently

Different roles across the organization are empowered to engage in research activities—and they do so more frequently.

5.1x

more likely to run generative research

Insights-led organizations put customers’ needs front and center and are proactive about discovering new opportunities.

1.5x

more likely to invest in research tools

As maturity grows, teams invest in tools that support different types of research and streamline every stage of the process.

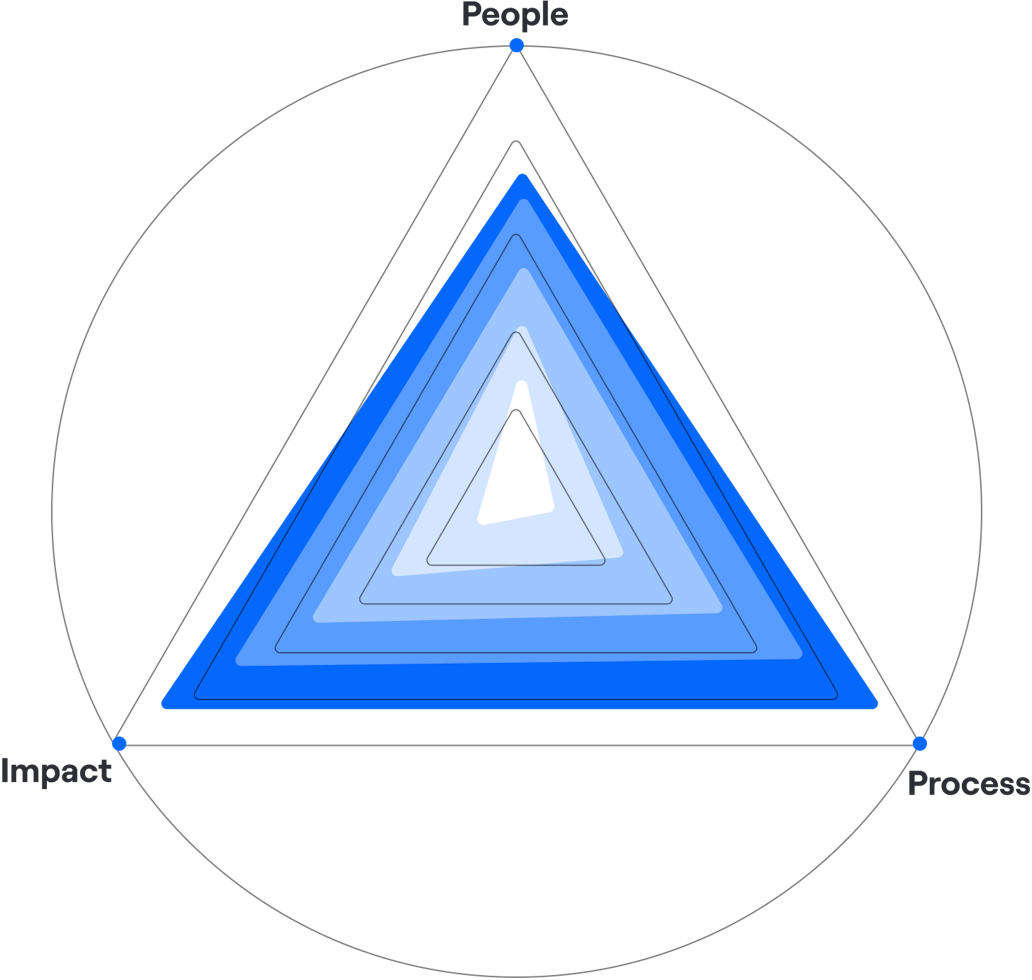

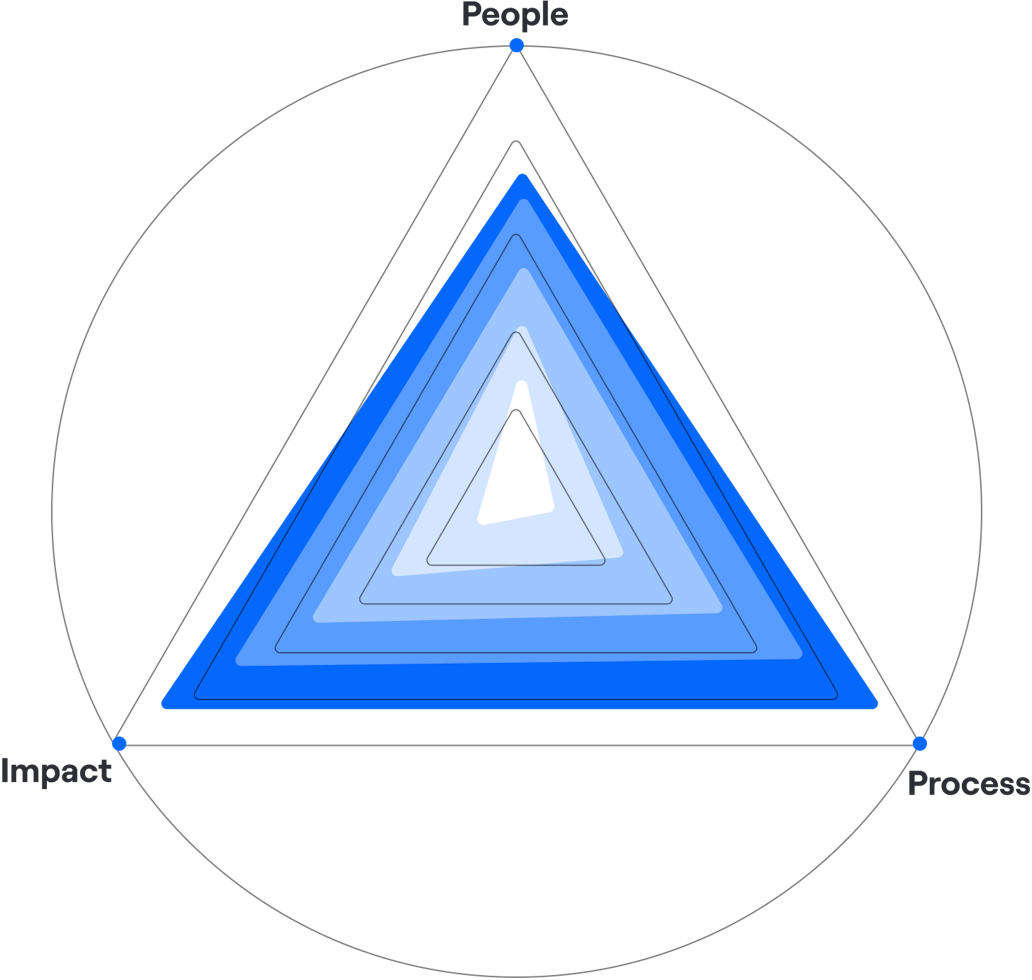

The 5 levels of research maturity

The model defines five levels of research maturity across three key dimensions: People, Process, and Impact. Learn more about each level and how to scale user insights organization-wide.

People

The talent gathering user insights, research representation at the leadership level, and the degree of executive buy-in and support.

Process

The frameworks, tools, and methods adopted by researchers and teams to make their work more consistent and efficient.

Impact

The reach of research across the organization, its influence on decision-making, and its impact on critical business outcomes.

Level 5

Strategic

3% of organizations surveyed

Research informs strategic decisions and helps organizations set long-term goals and priorities.

Research is represented at the top level of the organization and is leveraged to explore new opportunities and inform strategy, direction, and vision. Organizations have well-established research processes and provide appropriate training and education programs to enable different teams to leverage research and make better, informed decisions.

How to maintain Level 5

Focus on highlighting the connection between research and business outcomes to keep leadership interested in and supportive of research

Assess and iterate your research processes on a regular basis to ensure their efficiency and scalability

Provide career development opportunities for researchers to help them stay up-to-date with the latest industry trends and develop their skills

Level 1

Limited

2% of organizations surveyed

Research is only used to monitor and optimize products after they’ve been released.

Organizations only monitor passive sources of information—such as analytics, customer support insights, and product feedback—to assess how the product is doing and identify opportunities for optimizations. Executives are either unfamiliar with the concept of research or don't understand what it really entails, and the value it can bring. As a result, there's little or no investment in research staff, processes, and tools.

How to elevate your research practices

Educate your stakeholders on the fundamentals of user research

Focus on the benefits for customers and the organization

Identify opportunities to start conducting research at your organization and introduce data-gathering activities earlier in the product development process

Level 2

Sporadic

17% of organizations surveyed

Research is conducted on an ad hoc basis to validate design decisions and improvements to the product.

Organizations engage in ad hoc research activities to test new or existing solutions, and collect data to validate design decisions and uncover opportunities for improvement. At this stage, executives understand what research entails but don't necessarily see its value beyond validation. Investing in dedicated research staff and processes isn't a priority for the organization.

How to elevate your research practices

Encourage more functions to participate in insight-driven activities to show them how user-centered decision-making drives business impact

Educate them on the different types of research to help build more informed, collaborative partnerships across teams

Find champions who will help promote research activities and findings to senior stakeholders

Level 3

Developing

45% of organizations surveyed

Research comes into projects earlier to explore the problem space and inform roadmap decisions.

Product teams at the Developing level conduct research from the early stages of product development to understand user needs and problems, and build the best solutions to solve those problems. However, organizations might still lack established processes for running research continuously across different teams and projects, or they are at the beginning stages of establishing these processes.

How to elevate your research practices

Start standardizing the tools and workflows you've been using to conduct research

Develop a clear research strategy to guide your research activities and emphasize the value of research across the organization

Involve internal stakeholders and business leaders in the conversation to tie your strategy to business goals and get your executive team to buy in

Level 4

Systematic

33% of organizations surveyed

Research is conducted throughout the product life cycle to inform product and business decisions.

Organizations have made strides to elevate research maturity. This translates into an environment with organization-wide buy-in and support for research. A dedicated research team starts to form, allowing researchers to focus on more strategic requests and develop better processes and frameworks for conducting studies and sharing findings across the organization.

How to elevate your research practices

Empower different teams to engage in research and get access to the insights they need to make informed decisions

Introduce a ResearchOps program to optimize your research efforts

Educate researchers to speak the language of the business, becoming part of strategic decisions and building executive buy-in and support

Leverage AI tools to free up time for more strategic research

Level 5

Strategic

3% of organizations surveyed

Research informs strategic decisions and helps organizations set long-term goals and priorities.

Research is represented at the top level of the organization and is leveraged to explore new opportunities and inform strategy, direction, and vision. Organizations have well-established research processes and provide appropriate training and education programs to enable different teams to leverage research and make better, informed decisions.

How to maintain Level 5

Focus on highlighting the connection between research and business outcomes to keep leadership interested in and supportive of research

Assess and iterate your research processes on a regular basis to ensure their efficiency and scalability

Provide career development opportunities for researchers to help them stay up-to-date with the latest industry trends and develop their skills

Level 1

Limited

2% of organizations surveyed

Research is only used to monitor and optimize products after they’ve been released.

Organizations only monitor passive sources of information—such as analytics, customer support insights, and product feedback—to assess how the product is doing and identify opportunities for optimizations. Executives are either unfamiliar with the concept of research or don't understand what it really entails, and the value it can bring. As a result, there's little or no investment in research staff, processes, and tools.

How to elevate your research practices

Educate your stakeholders on the fundamentals of user research

Focus on the benefits for customers and the organization

Identify opportunities to start conducting research at your organization and introduce data-gathering activities earlier in the product development process

Find out your organization's research maturity level

Take the quiz to discover how research-mature your organization is and quickly identify action steps to build a learning culture.

About the study

Background research

We worked closely with industry experts to review existing UX and research maturity models and identify the key themes and categories that influence research maturity. Based on this research, we developed a survey to test and define a new framework for measuring an organization's research maturity.

The online survey

We surveyed over 500 design, research, and product professionals from 475 organizations across 66 countries and 20 industries. The survey included self-assessment questions to calculate each organization’s research maturity score, as well as multiple-choice questions to validate our hypotheses and explore the relationship between research maturity and business performance.

The Research Maturity Model

Based on the survey results, we developed a theoretical model and framework to describe the journey toward becoming an insights-led organization. The new Maze Research Maturity Model outlines five levels of research maturity, ranging from Level 1 (lowest) to Level 5 (highest).

About Maze

Maze is the user research platform that makes products work for people, by making user insights available at the speed of product development. Maze allows designers, product managers, and researchers to collect and share user insights when needed most, putting them at the center of every decision.