Chapter 2

7 Simple methods to recruit research participants

Recruiting research participants can be a bottleneck for effective, scalable research. But it doesn’t have to be.

The success of your UX study depends on finding and recruiting the right participants, which means looking in the right places, and using the right participant recruitment methods.

How do you do that? Well, read on for a breakdown of the top seven participant recruitment methods; including pros and cons, how to use them, and which to choose depending on your UX research study.

What are participant recruitment methods?

Participant recruitment methods are strategies that help you find the ideal people to test your product and provide user insights for your UX research.

There are many places to look for testers—from niche communities to your own customer base and participant recruitment tools. Using the right method is crucial to finding your ideal participants—participants who align with your user personas, and can provide relevant insights towards your UX research objective, without wasting precious resources.

7 Effective ways to recruit research participants for a study

The exact method you use to recruit research participants will ultimately depend on your budget, available resources, and requirements.

That said, there are a lot of options out there for participant recruitment, so you can find a method that suits your research team and project. Some ways to recruit participants include using:

- Your personal network

- Online communities

- Social media

- Internal feedback and colleagues

- Your existing customer base

- Guerrilla testing

- Recruitment tools and research panels

Source | Personal network | Online communities | Social media | Internal colleagues | Existing customer base | Guerrilla testing | Participant recruitment tools |

|---|---|---|---|---|---|---|---|

Good for | Small research studies or initial product discovery | Niche studies or highly-specialized topics | Capturing opinions from a broad audience | First-pass testing or if you need testers with product familiarity | Working on product updates and developing features, or if you need opinions of existing users | Consumer-focused, un-targeted research | Studies of any size that require targeted and vetted participants |

Let’s take a closer look at the most effective ways to source research participants.

1. Leverage your personal network

A common way to gather user insights is by asking your friends, colleagues, family, and wider network to help you with research.

While an easy approach, there are a few things to bear in mind: firstly, only ask people from your network to participate in research if they fit your target persona’s bill or if your target audience is so wide that it includes everyone.

We often rely on personal networks or colleagues who fit the participant profile. While this method may not offer the same level of validity as a broader recruitment process, it can still yield valuable insights for quick, early-stage testing. It’s especially useful when time is limited or when testing broad usability rather than niche features.

Marcus Ahlstrand

UX Designer at TietoEVRY

Share

The upside to working with your network is that you can find enthusiastic research participants relatively quickly—especially if you have a broad network. It’s also a low-cost way to get participants.

That being said, look out for potential cognitive bias. Turning to friends and family for research insights can lead to biased feedback, as these research participants have a personal stake in your success. They may also hesitate to share critical feedback due to your personal relationship.

Consider whether these factors might influence your research, and, if so, whether it’s better to look elsewhere for research participants.

Pros:

| Cons:

|

2. Source participants for your study via online communities

If your immediate circle of connections doesn’t suffice, you’ve got plenty of other options. One of which is to tap into online communities like Slack and Discord channels or Reddit forums.

Andreas Johansson, User Experience Specialist at Telenor IoT, says: “Find communities where people similar to [your] intended target users hang out. For example, say I was designing a website builder, then I’d go to communities for existing website builders, as well as web design communities on Reddit, Facebook, and more.”

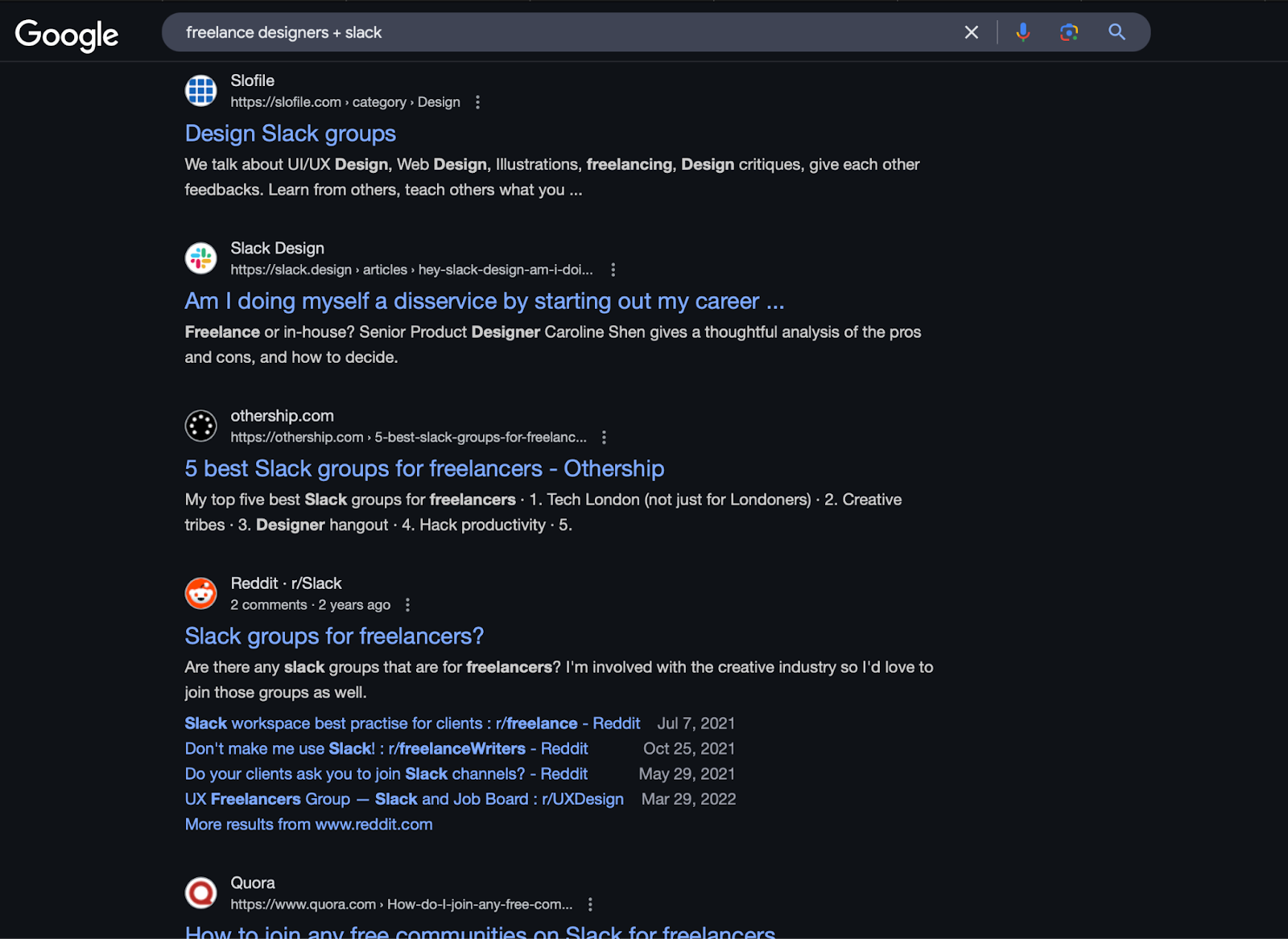

Andreas suggests you can find the right community by taking to Google and searching for: <name of community/persona + forum>.

For example, searching <freelance designers + slack> to find a target audience of freelance designers.

You can also go to Slofile, an online database of Slack communities, to find your target audience on Slack.

In some online communities, you might need a forum moderator’s permission to connect with research participants. In that case, it’s best to talk to them by explaining the purpose of your post in the community before posting your request.

A good way to encourage people to participate in your research is to use a community engagement approach rather than posting and disappearing.

When you show up as a regular in a community and engage with its members, they’re more likely to recognize you and help, versus when you�‘re a stranger posting for the first time. For this reason, it can be worth enlisting the help of any internal team members who may have an existing presence in these spaces.

Pros:

| Cons:

|

Remember when we spoke about snowball sampling in chapter one?

Recruiting users via online communities will also help with getting relevant participants—even if they themselves aren’t on the platform. Building relationships with users encourages them to refer their network, which often includes the participant profile you’re looking for.

3. Find research participants over social media

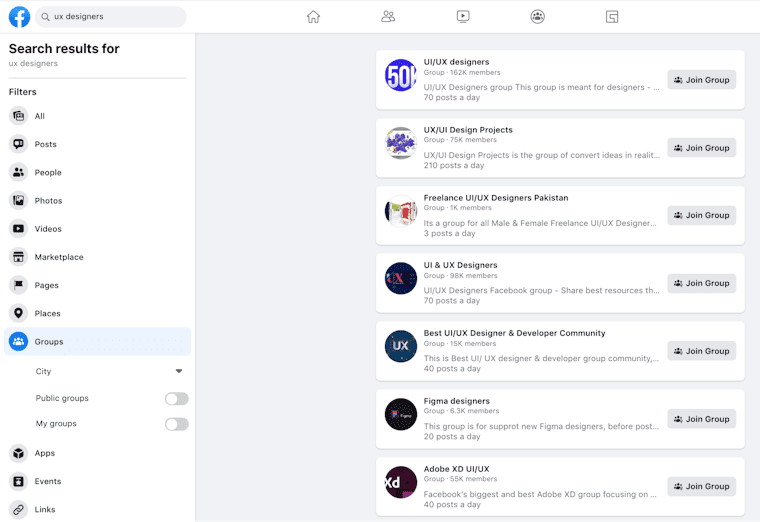

Facebook and LinkedIn groups are great ways to recruit research participants. As in the case above, you can take to Google and search for: <community name + social channel>

You can use the social channel’s internal search bar too, to find relevant groups or filter by location, if needed:

Alternatively, you can use LinkedIn cold outreach to connect with specific research participants based on job role, location, and more filters. Start by typing in terms that describe your target user in the LinkedIn search bar—for example, ‘UX researchers’. Then apply filters to narrow down on the demographic, industry they work in, and more.

Once you have a list of potential participants, send them a LinkedIn message explaining your search for test participants.

These methods are most successful when paired with clear incentives and transparent communication about the purpose of the study.

Marcus Ahlstrand

UX Designer at TietoEVRY

Share

Explain briefly why you’re reaching out, followed by sharing context (who you are and what your research is about). Then explain what makes them a good fit. Don’t forget to mention any incentive that you’ve planned for participants, and always close your message with a CTA, such as a link to the screening questions or the test.

Here’s a template to give you an idea:

Hi [name],

I’m reaching out to you on behalf of my team at [company name] to express our interest in collaborating with you over [explain your research briefly]. I’m [name] and I work as [your role].

We find that you’re a good fit because [reason]. If this interests you, you’ll only need to [explain research process]. It shouldn’t take over [time it’ll take], but for all your help, we’d be happy to [share incentive if planned].

If you’re in, please let me know, and I’ll share more details with you.

Thank you,

[Your name]

Bear in mind that cold outreach like this doesn’t have a hugely-high success rate, but it is cost effective. You can also consider directly posting a call for participants on social media platforms—this could be from your own account, the company’s brand account, or an internal figure with a larger following (e.g. your CEO, or any internal thought leaders).

Finally, another tactic to gather research participants via social media: use paid ads to find target users, particularly when you’re validating a new idea or trying a new market for a consumer app.

For between $50–200, you can run targeted ads on X (formerly Twitter), Instagram, and Facebook to reach out to specific personas—targeting by country, age range, skillset, or other filters.

However you reach out, remember to include a link to a survey or a form to gather information on potential test participants. Use the info you gather to filter and screen participants before reaching out to them again with specific research details.

Pros:

| Cons:

|

4. Get internal feedback

This method is ideal if you have in-house experts that fit your target persona’s description—as Canopy did when testing its Help Center design with Maze.

Internal feedback can also be great for gathering initial input on a problem your product aims to solve. However, you can’t solely rely on internal feedback—bear in mind that you’ll still need an unbiased, target audience to test the product further down the line.

Gathering internal feedback is best for product discovery—the process of framing a problem and getting a sense of what you need to do to solve it. It also helps with early-stage usability testing by sharing your wireframes or low-fidelity prototypes to test your design’s functionality.

For example, you could conduct 1:1 interviews with internal stakeholders, request them to fill in UX surveys, or host focus group sessions to encourage discussions around your audience’s frustrations, behavior, and emotions with a product or issue.

But don’t limit your research radius to just close colleagues. Use this method in combination with other methods listed here to recruit research participants that fit your target user personas for any subsequent research.

Pros:

| Cons:

|

5. Curate a pool of existing customers for participant recruitment

Customer Service, Support, and Sales teams are in constant communication with your customers—learning what frustrates them, understanding their pain points, and what new features they wish your product had.

Work with these teams to curate a list of enthusiastic customers who love your product and would like to help you improve it. Recruiting participants by working with the teams who are already in constant contact with them is helpful when you’re planning product updates, in-app tweaks, or introducing new features.

At Maze, for instance, we have a Customer Advisory Board of more than 90 customers who give us feedback on new and existing features. Customer feedback from the committee has been incredibly valuable in our product development process.

“In one conversation with this customer, we went from a simple duplicate feature to the possibility of having an entire testing library in Maze. This is the hidden gold the Customer Advisory Board reveals,” shares Nelson Castro, Lead Customer Success Manager at Maze.

Besides an advisory board, consider the following options to curate customers for research:

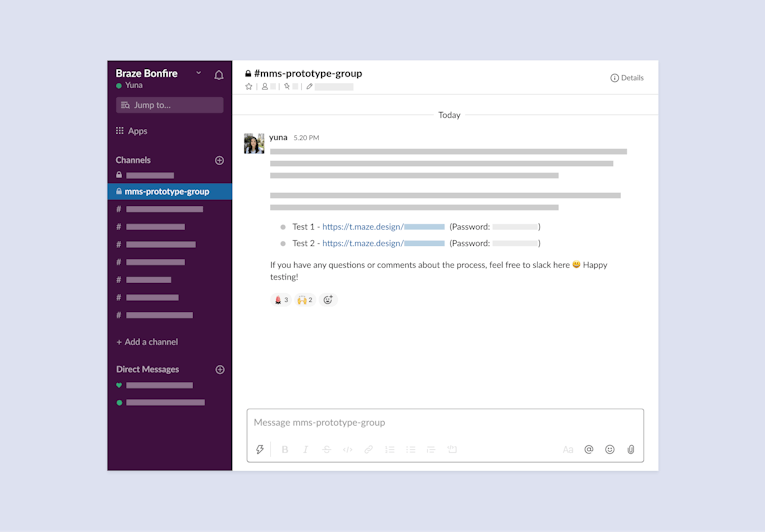

Create an online community: For example, Freetrade has a community of users they refer to for research and getting feedback. Create a private Facebook group, or build your customer community in Slack like Braze’s Braze Bonfire Slack group, where they share links to their tests with customers who are interested in evaluating the prototype.

Braze uses a private Slack channel to invite testers

Another option is to leverage WhatsApp or other messaging platforms to keep in touch with your customers and ask the community for research and feedback. For example, Tiendanube has WhatsApp user groups where they share links to design tests.

Create an early access or beta group of current and prospective customers who are interested in testing your product for usability. Post-product launch, continue using this group as a research channel.

Now that you’ve got all these ideas to create online customer communities, the question is: how do you get customers to join your community?

Try this:

- Run an email campaign to onboard customers. Send an email informing customers about your group and ask if they’d be interested in joining.

- Create a page on your website dedicated to your community. Share links on your social channels or place a pop-up notification on your homepage to encourage folks to join.

- Offer an incentive to prospective participants to encourage them to get involved with your research. This could be a reduced monthly subscription to your platform, a gift card, or even a cash payment for their time.

Geoffrey Crofte, Senior UX Lead at Groupe Foyer and UX author, shares how his team at Groupe Foyer has built participant recruitment into their digital process:

“We created a User Club that we first recruited using marketing emails to existing clients. We continue to grow our participants list by building it into a key step of our digital process. When clients open their mobile app or client area on our website for the first time, they get a small intermediate screen where they can approve marketing and User Club subscription.”

Pros:

| Cons:

|

6. Find test participants with guerrilla testing

Have you ever encountered people on a busy street sharing samples of new products, be it perfume testers, a free CD, or ice cream samples?

Guerrilla testing is pretty similar. It consists of going to a busy place, stopping strangers on the street, and asking them to share their thoughts on your design—likely a prototype or wireframe.

It’s a quick and affordable way to get insights from ‘regular’ people—making it a good option when testing products targeted at everyday consumers, like an online shopping app or healthcare portal.

However, guerilla testing does have some limitations. Firstly, you need to consider the validity and depth of the insights collected. People on the street are hardly invested in providing thorough feedback—they’re likely looking to move on as quickly as possible.

Secondly, it isn’t suitable for collecting feedback from specific demographics. You’re turning to the general public, not a select group of people who fit your demographic needs. You can’t assume demographic data based on appearances.

Due to these limitations, guerilla testing is best for general, untargeted user research. It’s a great way to connect with a wide variety of users quickly and affordably, but avoid using guerilla testing if you want to reach a specific demographic of users.

Pros:

| Cons:

|

7. Use participant recruitment and management tools that find test participants for you

Lastly, the most fool-proof recruitment method is opting for a participant recruitment tool (more on these in the next chapter!).

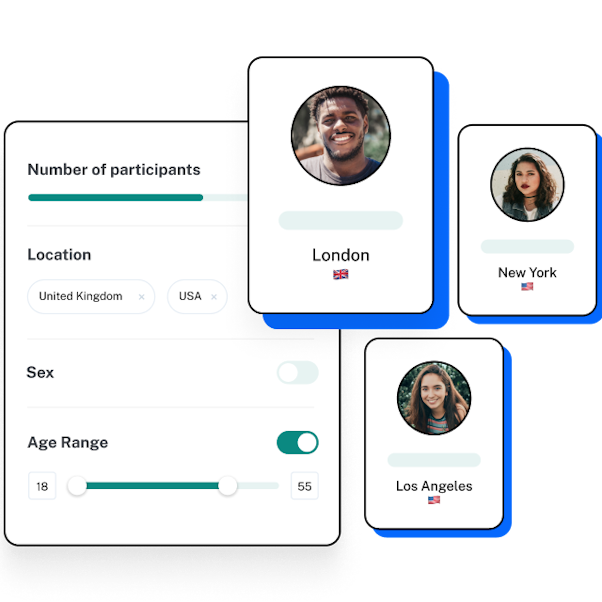

Using a tool to find research participants can significantly speed up and streamline your recruitment process, as well as optimizing the quality of testers. While this method often requires payment, it can be well worth the investment to secure the right users when you need them for your study.

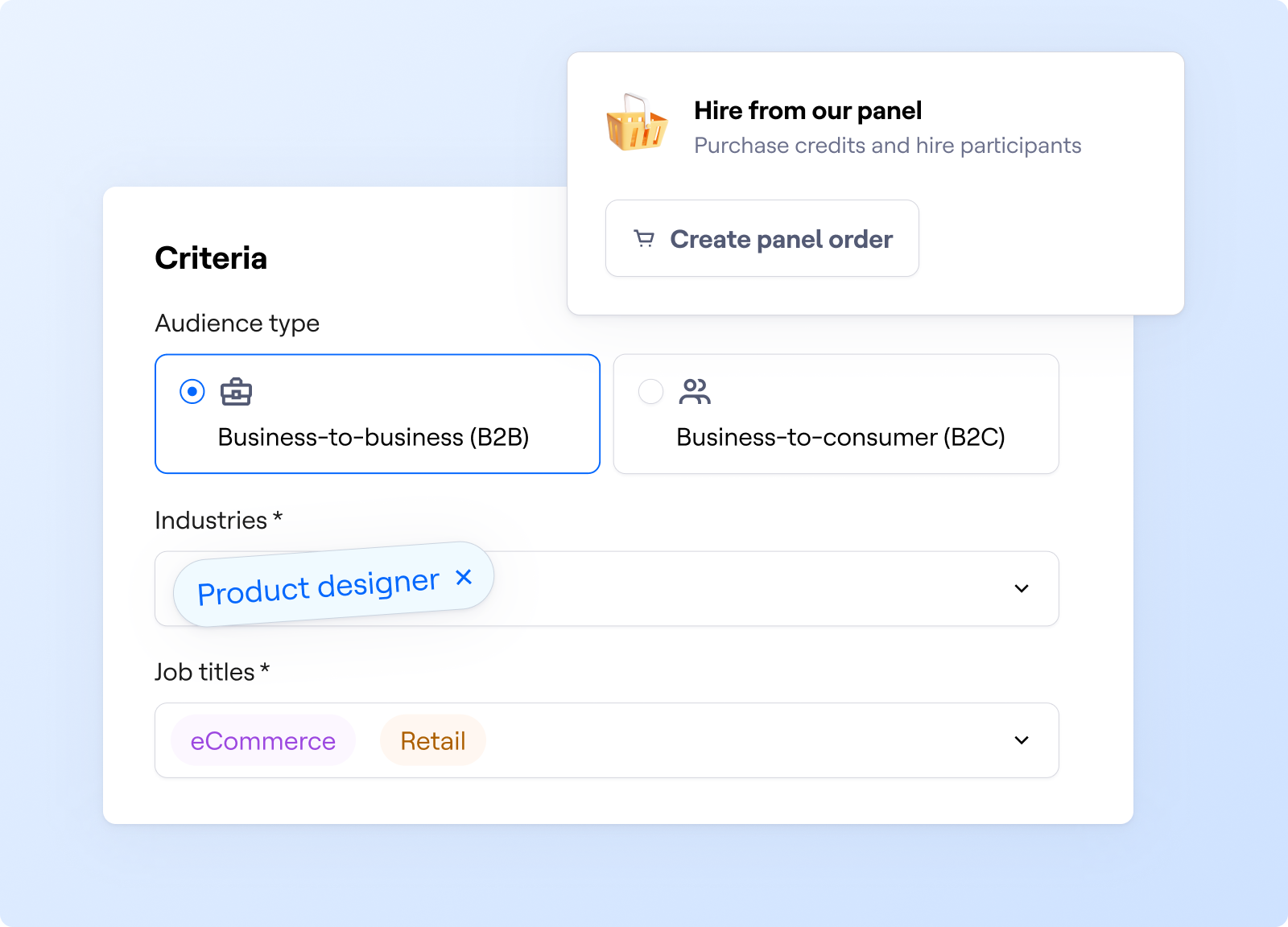

One key benefit of using participant recruitment tools is the ability to nail down the specifics, from location to demographics. For example, if you’re creating a medical app that helps young doctors in New Zealand find available medicines, you’ll need doctors in the country between the ages of 24 and 35 as your research participants. Participant recruitment software helps you home in on that demographic.

On top of that, recruiting testers using UX research tools is great when you need a lot of participants, such as for quantitative testing. Maze, for instance, offers two solutions to help you locate and manage the right participants:

- Quickly source research participants with Maze Panel: Filter participants based on your target demographic and get results in hours, not days

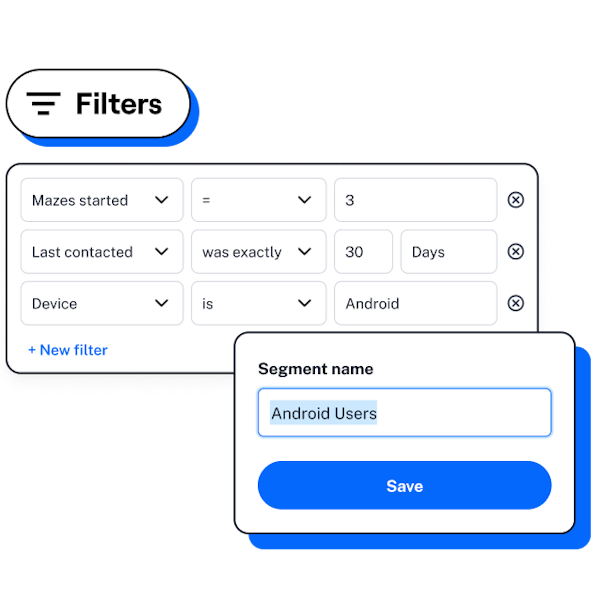

- Create a dynamic database of testers with Maze Reach: Automatically group participants based on traits and metrics to create user segments and send email campaigns for future research

Reach by Maze

Pros:

| Cons:

|

Reach the right participants in hours, not days

With over 400 filters and 130+ countries to choose from, Maze’s Panel makes finding the perfect participants quick and easy.

When and why to use specific participant recruitment strategies

With seven participant recruitment strategies, you’re spoiled for choice. But which is the best one for your UX research study? The ideal method will depend on the type of data you’re collecting, whether you’re meeting with participants, and if you’ll be moderating the session.

Qualitative vs. quantitative data

Before settling on a participant recruitment method, consider whether you’ll be collecting qualitative or quantitative user data.

UX research methods like user interviews, focus groups, card sorting, and open-ended surveys collect qualitative data. This data type is depth-focused, helping you uncover user attitudes and viewpoints, as well as the reasons behind them.

Qualitative UX research methods require participants who are closely aligned with your user base. The goal here is searching out niches to recruit participants who can provide highly specialized feedback—depth over volume is the golden rule. Consider:

- Leveraging your customers as participants

- Reaching out to communities

- Signing up for participant recruitment tools

For quantitative research methods like close-ended surveys and some usability testing, you need statistical significance, otherwise, your findings won’t be generalizable.

This requires more participants, so the best recruitment methods will give you broad access to potential testers. Look at:

- Putting out adverts on social media

- Leveraging customers as participants

- Signing up for participant recruitment tools

- Conducting guerrilla testing

Keep in mind that participants still need to align with your preferred user base for insights to be useful.

In-person vs. remote

The good news is that almost all the methods we listed, except for guerrilla testing, work well for remote testing participant recruitment.

For remote user research, prioritize methods that put you in touch with people all over the globe, such as:

- Recruiting via social media

- Reaching out to communities

- Using participant recruitment tools with global reach

For in-person testing, prioritize methods that help you find potential participants in your proximity:

- Talking to colleagues if you share in-person offices

- Conducting guerrilla testing

- Setting up geographical filters on social media or recruitment tools

- Reaching out to your customer base as existing meetings or events

Moderated vs. unmoderated research

Moderated research methods, such as interviews or focus groups, require you to be present throughout the session. These testing types naturally require deeper discussions. Prioritize recruitment methods that give you access to people who closely align with your user base:

- Utilize customer relationships

- Use participant recruitment tools

- Leverage your personal network

- Reach out to online communities

If you’re conducting unmoderated sessions, like usability testing or prototype testing, you’ll want access to the largest number of users, letting you distribute tests quickly and efficiently. Try:

- Using participant recruitment tools

- Recruiting on social media

- Reaching out in online communities

Dos and don’ts for recruiting research participants

Before we close out on recruiting research participants, let's run through some key dos and don'ts to remember when recruiting users.

Do 👍 | Don't 👎 |

|---|---|

|

|

Recruit user research participants with Maze

Using the right method for recruitment is crucial because it saves you from having to scour the web (and the world) for participants who might not even fit your user base. From using social media to leveraging your company’s experts, there are plenty of resourceful ways to single out ideal research participants for insights.

Two especially effective and easy methods are through Maze Panel and Reach.

With Maze Panel, you have access to top-tier testers around the globe. Start by creating your Maze test and sending it live. Then, you can place an order and use the Maze Panel’s 400+ filters to find your ideal participants. Next, select between 1 and 250 for your testers, and proceed to checkout. As soon as you get your order summary, results will come pouring in.

With Maze Reach, you can import your testers to create a database of study participants and keep track of results. When it’s time to recruit again, organize them into dynamic segments, filter to find the best options for your research, and send campaigns via email for your next study.

Overall, Maze makes it easy to find, filter, and recruit the ideal participants for your next UX research study. Join us for the final chapter of this Participant Recruitment Guide for more on Maze Panel and Reach, as well as the other participant recruitment tools available to you.

Reach the right participants in hours, not days

With over 400 filters and 130+ countries to choose from, Maze’s Panel makes finding the perfect participants quick and easy.

Frequently asked questions about participant recruitment methods

What is an example of participant recruitment?

What is an example of participant recruitment?

Let’s say you’re about to conduct usability testing to assess a hi-fi prototype for an HR platform. To find the best candidates for testing, you take to LinkedIn and use the filters section to find HR companies and professionals that align with your user base. After singling out 15 people, you send outreach messages, asking them to participate and providing details of your study.

What are the different recruitment methods?

What are the different recruitment methods?

The seven participant recruitment methods you can use for your research project include:

- Leveraging your personal network

- Sourcing participants via online communities

- Finding participants through social media

- Getting internal feedback

- Curating a pool of existing customers

- Finding participants with guerrilla testing

- Using participant recruitment and management tools

What is the participant selection process?

What is the participant selection process?

The participant selection process for your UX research study includes:

- Outline your research plan and goals

- Identify ideal research participants

- Create effective screener questions

- Identify research recruitment channels and methods

- Onboard research participants