Chapter 3

Recruiting for user interviews: How to reach your ideal research participants

Let’s be honest—participant recruitment can be a hassle. You spend time scouring sources and sending emails to try and recruit users, only to find they don’t reply to you, they don’t match your selection criteria, or their availability is impossible to work with.

Nonetheless, the value of impactful insights gathered from the right participants far outweighs the effort needed. And with the right participant recruitment strategy, recruiting research participants for your next interview study can feel as smooth and effortless as the intuitive interface you’ll build with their insights.

In this article, we show you how to find and recruit the best candidates for your user interviews in five steps—complete with three best practices to guide you along the way.

But first, let’s start with the groundwork: how many participants you need to recruit, the difference between recruiting for general UX research and specifically for interviews, and the pros and cons of in-person vs. remote recruitment.

How many participants do you need for user interviews?

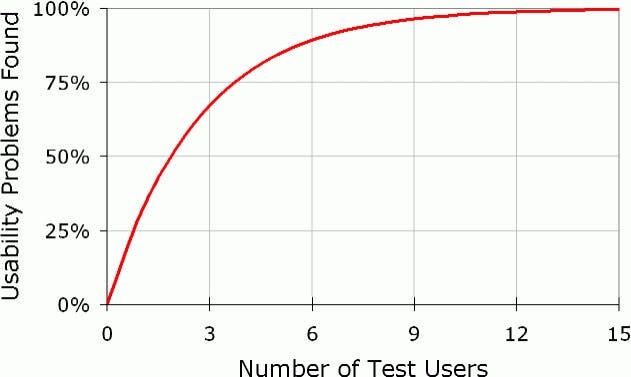

There’s no golden rule for the exact number of research participants ideal for your user interviews. In his famous article titled ‘Why You Only Need to Test with 5 Users’ (2000)’ Jakob Nielsen argued that a five user sample size is enough to uncover 85% of user problems.

Any number larger than that, and you start to get diminishing returns. You’re conducting lots of testing, but getting fewer new results. Ever since the Nielsen article came out, five has been hailed as the magical number of all sample sizes for user research testing.

However, there’s a few problems with this approach:

- It doesn’t take into account differing groups, types of users, or personas

- The article refers to usability testing rather than interviews

- The data was based on very few studies, from a time when user experience research was expensive and undemocratized

In user interviews, your aim is to achieve saturation with your sample size. This is the point where themes for interviews begin to constantly repeat themselves and new insights stop emerging with each interview.

Since interviews are about digging deep into people’s underlying experiences, instead of evaluating features on an interface, the point of saturation is likely to be in a greater range—eight to twelve participants, depending on your study.

However, you might be seeking to test different user personas or customer types. If these groups have widely differing wants, needs, and experiences, then you need to multiply your sample.

That gives us this formula:

Total sample size = sample size for one persona X number of personas

For example, let’s say you’re conducting interviews for a recruitment platform. You have two user personas; corporate recruiters and job seekers. Settling for eight interviews per user persona gives you a grand total of 16 interviews.

💡 Don’t be afraid to play it by ear!

While eight interviews can be enough in some cases, you may need to conduct more to properly flesh out potential themes. Or, if you’re running low on resources, then you may need to settle for the lower end of the eight—twelve range.

Recruiting for user interviews vs. recruiting for UX research: What’s the difference?

While recruiting for user testing in general and recruiting specifically for user interviews are similar, there are a few notable differences to bear in mind. Namely, differences across:

- Specificity

- Outreach

- Screening

- Participant profiles

- Incentives

Specificity | Outreach | Screening | Participant profile | Incentives | |

|---|---|---|---|---|---|

User interviews | Smaller participant group closely resembling your desired user profile | Contact potential participants through email, social media, or specialized recruitment panels or agencies | Detailed screening to ensure participants meet specific criteria | Participants based on detailed criteria that align with the UX design research objectives | Higher incentives for in-depth participation |

General UX research | Larger, more diverse group of participants for a wide range of data | Utilize online panels, email lists, social media ads, and crowdsourcing platforms to reach a broader target audience | Statistically significant sample size representative of the overall user base | A broad range of participants with different backgrounds, demographics, and usage patterns | Incentives based on the type of study and duration of participation |

Simon Bacher, CEO and Co-founder of language-learning app, Ling, emphasizes the difference in persona for user interviews vs. more general research. “We’ve always had to create detailed user personas before recruiting for user interviews. It helps us understand users’ needs and motivations better, which in turn makes our future research questions rich and specific.

“For example, we developed in-depth personas such as Casual Learner or Language Enthusiast, helping us understand user motivations and tailor the app accordingly. On the other hand, for general user research, personas are simpler and less detailed, like Young Adults Interested in Language Learning or Professionals Seeking Language Skills, mainly to guide broad marketing strategies.”

Remote vs. in-person user research recruiting

Before you can get into recruiting user research participants for your study, you first need to decide between recruiting participants in-person or recruiting and conducting remote user research. Both methods have distinct advantages and a few fallbacks.

Geographical constraints | Logistics and coordination | Recruitment reach | Environment | Screening | Budget & incentives | |

|---|---|---|---|---|---|---|

In-person recruitment | You’re limited to participants in a specific geographical location | Arranging interviews requires arranging physical meeting locations, scheduling research session times, and traveling | More localized, meaning you may need to use local networks and community boards | Consistent controlled environment for participants | Screening may require more face-to-face meetings and phone calls | May require a larger budget to cover travel expenses, venue hire, and higher participant incentive due to travel expenses |

Remote recruitment | You can recruit participants from a wider geographical area, including different cities and countries | More flexible scheduling, requires participants have the appropriate technology | Broader reach options, including recruitment services and social media | Less controlled participant environment, but participants may act more naturally | Screening conducted entirely online with surveys and test-runs | Typically only includes participant incentives |

Jane Davis, Senior Project Manager of Growth at Maze, emphasizes the extra effort that goes into screening for in-person interviews compared to remote recruiting:

“I always, always screen participants for in-person work. This lets me start to establish rapport with potential participants, assess whether they’re going to be good interview subjects (in the sense of not just giving yes or no answers and having the actual experience or qualifications I’m looking for) and screen out anyone who isn’t a good fit.

“In-person interviews are much more time and effort-intensive, so you really need to ensure that each one is a good use of your resources

“For remote interviews, I’ll still try to screen participants to make sure they’re a good fit, but it’s much easier to cut the interview short, so if I’m short on time, I might skip doing a phone screen and just rely on a screening survey instead.”

How to recruit users for user interviews in 4 steps

There are many ways to recruit users for your next interview studies. However, finding participants who are ready to give you in-depth interview responses requires a carefully prepared approach—just like conducting interviews themselves!

Before you apply these steps, make sure you have both your UX research objectives and any user personas on hand. Reviewing both your objectives and personas gives you a clear picture of who you’re looking for, helping you identify the ideal participant for your study.

Here’s how to recruit users for your user interviews in four simple steps.

1. Establish your recruitment criteria

Think of your recruitment criteria as a camera lens. It helps you focus on your ideal participant’s qualities, giving you a clear picture of what they do in their daily lives and how they use your product. Some of your criteria can depend upon:

- Psychographics

- Behaviors

- Demographics

- Geographics

Clearly defining your recruitment criteria is a balancing act. You don’t want your criteria to be too general, as this leads to an unfocused participant profile. It will make finding a large number of participants easy, but the right type of participant much more difficult. On the other hand, make your recruitment criteria too specific, and you’ll struggle to find any participants at all!

What I’m really looking for are, ‘What are the behaviors we want to understand as part of this research, and what populations do we think generally engage in those?’

Jane Davis

Senior Project Manager of Growth at Maze

Share

Bear in mind your recruitment criteria and your user persona characteristics won’t necessarily match, and that’s okay. Not all your users falling into a persona category can help you gain wider customer insights from users on the periphery or folks who tend to go under the radar.

Here’s how Jane goes about establishing recruitment criteria for user interviews:

“I look at the target audience for what we’re trying to build or learn, and work from there. Most of the time this will be more about certain behaviors or patterns they have, rather than demographic qualities like age or gender.”

What might this look like in practice?

Let's say you’re conducting user interviews for a video editing software called BreakBit. Your main user persona is content creators who use your software to shoot, edit, and upload videos to streaming platforms.

Your UX research objective is to explore how usable and efficient BreakBit is for turning out and uploading multiple videos a day. Following both these elements, your recruitment criteria would be users who:

- Regularly use the product for editing multiple videos a day

- Are professional content creators rather than just hobbyists

- Regularly use your fast edit mode setting for faster uploads

- Who have the pro subscription, supporting more than two video edits daily

✨ Pro tip

Sharpen your recruitment criteria by defining what characteristics your ideal participant doesn’t have. This will help you save on time-consuming tasks throughout the recruitment process such as screening your participants.

2. Set up a screener survey

A screener survey is like a filter. It helps you identify potential participants matching your criteria while disqualifying those who don’t. To create a screener survey, start by writing out a list of 10 non-leading, unbiased questions based on your outlined criteria. You can then use the results of your screener to select the best-fit participants.

Let’s say you’re designing a screener survey for BreakBit. Based on our previous criteria, some questions for your screener survey may include:

- How often do you use BreakBit for your video shooting, editing, and uploading?

- How many videos do you typically edit and upload using Breakbit?

- Do you create videos as part of a hobby or as part of your daily work?

- How often do you use the fast editor mode?

- What BreakBit plan are you currently on?

Keep screener surveys short and simple. Stick to close-ended, multiple choice, and Likert rating scale questions. This helps you quickly analyze your results and screen through users who are a good fit for your user research study. You should also keep your questions detailed. With qualitative research like interviews, you’re focused on recruiting a smaller number of focused participants for your study.

3. Choose your recruitment channels

Now that you know who you’re looking for, it’s time to go out there and find them. Typically, recruiting for interviews requires a more targeted approach to reach participants who regularly engage with your product.

Since you’re not looking for statistical diversity like with quantitative research methods, this narrows your recruitment channel options down to:

- Participant recruitment panels: Pre-existing panels of research participants to choose from based on your criteria, like Maze Panel

- Email lists from newsletters: Here, you’re more likely to find engaged users already familiar with your service

- Targeted social media ads: Posting ads on specific social media platforms, such as LinkedIn, can attract users who fit your recruitment criteria

- Online product review sites: Reviewers on sites like G2 and Capterra often write about how they use products and address specific features, making it easier to find potential participants for your study

- In-product recruitment: Tools like Maze’s In-Product Prompts let you recruit users are they interact with the product, capturing live, in-the-moment feedback from real users

In our BreakBit example, you’re looking for content creators who actively use the quick editor mode, so it makes sense to use an In-Product Prompt appearing for those who activate the feature. This allows you to ask users interacting with the quick editor mode your screener questions and even recruit them directly.

4. Select participants from your pre-screened candidates

Once you’ve distributed your screener survey across a number of channels, review and analyze the response to find your best-fit candidates. Some participants will be an instant yes or no, while others might require more consideration.

Now you’ve got screened candidates, select eight to 12 participants to partake in your interview study and start sending out those invites!

💡 Pro tip

To ensure the screening part of the research recruitment process goes as smoothly as possible, we recommend using a research tool that analyzes and sorts your results—like Maze’s pre-research screener surveys.

Recruiting for user interviews: 3 best practices

Ensuring you have a steady stream of interview participants isn’t just about looking for them. It’s about making your offer attractive to users, ensuring diverse recruitment pools, and utilizing the best channels to reach your target audience quickly and efficiently.

To help you on your way, here are three interview recruitment best practices to ensure you find high-quality participants for your study.

1. Incentivize users with rewards

Interviews are resource-intensive research initiatives. They require considerable time, energy, and coordination—for both you and your participant. To make the offer more attractive, provide an incentive. This increases the chance your users will respond, by showing that you value their opinions.

Incentives might include:

- Early and free access to new products or features

- Coupons and gift cards

- Brand merchandise

- Monetary compensation (for in-depth interviews)

Bear in mind that incentivizing participants means you’re likely to attract more candidates who aren’t genuine users. This is where your screener questions come in! Additionally, choosing a reward linked to your product or industry (such as a free premium trial) can help ensure users are legit.

Here’s how Derek Pankaew, Founder of Listening, approaches interview incentives:

“Make sure participant rewards are useful and functional. At this level, your most valued participants are likely already committed users. Perks like exclusive feature access, VIP rewards, loyalty discounts, or sneak peek content is really valuable for this pool.”

“But truly do your due diligence with relevancy and appeal research—don't assume something is valuable. In some cases, it's even smart to let participants leverage the study themselves as a resume builder, especially if they work in UX or a related tech field themselves.”

2. Recruit with the help of a panel

You can always make use of your social media pages, targeted ads, and review websites. But what if you’re just not attracting the right type of people for your study? What if you’re spending too much time and effort to find and recruit the ideal participants?

That’s what panels are for.

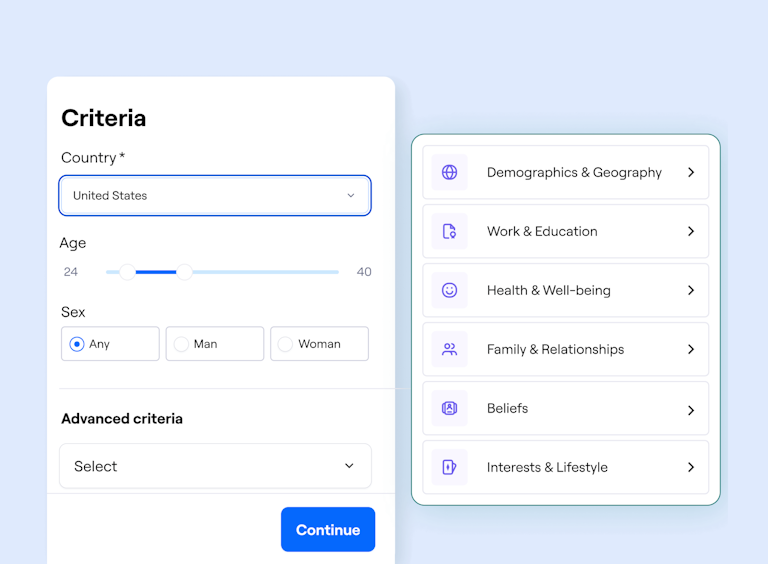

For example, Maze Panel has over 400 filters, enabling you to target potential participants from over 130 countries with precision. Using Panel makes it easy to find participants that match your exact recruitment criteria, all in the click of a button.

3. Foster long-term relationships with your participants

A high-quality interview participant is hard to come by. That’s why you want to hold on to them when you find them.

Fostering your relationship with great research participants encourages them to return for future research studies—enabling you to get insights in a jiff. This helps you save time and energy when recruiting for your next research study, plus it builds a strong relationship with users by showing you value their perspective.

There are a few ways to maintain a relationship with your interview participants:

- Express appreciation through thank you notes: A personalized email or handwritten note expressing genuine gratitude to your participant shows you value their time, opinions, and effort

- Share results: If your study allows it, you can share outcomes and how you’ve applied your participant’s insights, helping them see the value of their contribution

- Build, host, and invite them to online communities: Consider creating a community, such as a forum or regular webinars, where participants can interact with each other and your team for content or guidance

- Use a participant management solution: Tools like Maze Reach allow you to build a database of research participants, send them targeted campaigns, and discover your most engaged and responsive users

Here’s how Jane initiates a long-term relationship with first-time participants:

“Usually, I wait until after the first interview to determine whether someone is a good fit for being a member of our research panel or a future participant. If they are, I’ll ask them directly if they’d be willing to be contacted for future research needs.

“If they’re amenable, I’ll add them to my list on Reach. I like to try to keep panel members who aren’t getting regularly contacted for research engaged by sending occasional emails, either asking them to confirm their participation, or simply saying, ‘Thanks for being a member of our panel’ and sharing the latest research we’ve done.”

Recruit the right users for your interviews with the help of Maze

Without research participants, conducting user interviews is impossible, which makes participant recruitment a top priority for your UX team. But it’s often easier said than done.

Enter: Maze

Maze is the leading user research platform that empowers all businesses to uncover decision-driving user insights. Alongside a comprehensive suite of user research methods, Maze also supports research participant recruitment with Maze Panel, Recruitment Links, and In-Product Prompts.

Panel enables you to filter your search and recruit your ideal users from a participant pool of over 280 million testers, while In-Product Prompts allow you to target your own users during their product experiences. You can then manage your participants in Reach, Maze’s purpose-built participant management platform.

Plus, when all’s said and done, and you’re left with hours of interview data to sift through, Maze Interview Studies provides the AI-powered analysis capabilities you need to turn your data into insights.

Frequently asked questions about recruiting for user interviews

What are the common mistakes when recruiting for user interviews?

What are the common mistakes when recruiting for user interviews?

Some of the common mistakes when recruiting for user interviews include:

- Lack of clear criteria

- Ignoring user diversity

- Not utilizing the right recruitment channels

- Not setting up a screening survey

What are the different methods of recruiting participants?

What are the different methods of recruiting participants?

There are a few methods to find the right participants for both quantitative and qualitative studies. For both types of research, recruitment includes:

- Recruitment agencies

- Online panels, such as Maze Panel

- Email lists

- In-Product Prompts