Banks today are racing to keep up with a major shift: customers now expect the same smooth, intuitive experiences from their financial institutions as they do from their favorite social media apps.

Modern banking customers expect convenience, personalization, and digital tools that simplify their financial lives—and they’re increasingly inclined to switch providers if their needs aren’t being met.

In this article, we look at today’s trends shaping the future of customer experience in banking and what customers expect from their financial institutions.

How CX can impact ROI and revenue

Positive customer experiences create a ripple effect that directly boost a bank’s bottom line. Research into CX in banking found that over 82% of respondents see CX as the leading driver behind customer loyalty.

When customers feel valued and understood, they’re more likely to stay loyal, recommend the bank to others, and explore additional services such as loans, credit cards, or investment options.

It’s a domino effect: investing resources into improving the customer experience leads to increased loyalty, which means greater customer retention and reduced churn—subsequently leading to increased revenue.

The current state of customer experience in banking and finance

Banks and financial services institutions are going through a rapid transformation as customers move towards more personalized and accessible banking services.

As customer expectations evolve and the demand for seamless, personalized experiences intensifies, it has become clear that banks are at the forefront of digital transformation.

Sharanya Ravichandran

VP of Design at JPMorgan Chase

Share

The emergence of mobile banking apps, online platforms, and digital payment methods has changed how customers interact with their financial institutions. According to The Future of Finance Report, 88% of consumers say they prefer online banking, either through a mobile app (59%) or a desktop browser (29%).

The report shows that new technological advancements also mean that today's top performers are valued more like tech firms than banks. As technology removes barriers to innovation, understanding customer needs and providing exceptional customer experiences has become the key differentiator in an increasingly competitive market.

According to Zendesk’s CX Trends 2025 report, over the next three years, customer experience leaders want to focus on:

- Improving data security

- Investing in new CX technology

- Optimizing self-service support

- Using generative AI in customer experience

What do customers expect from their banks?

In her presentation, Digital Transformation in Consumer Banking, Sharanya Ravichandran, VP of Design at JPMorgan Chase, highlights three key customer expectations in the financial services industry.

1. “We can't just have products and services that are useful, they have to be usable"

It's not just about great ideas; it's about great execution, too. Customer experience solutions need to be made for the audiences that use them. Customers now expect financial services platforms to be secure, easy to navigate, and efficient.

2. “Customers want products that are sophisticated yet intuitive"

Banking can be complicated, but banking solutions shouldn't be. Customers want products that they can use and trust from the get-go. Sharanya adds, "As products become increasingly complex, it's important to make it easier for customers to unlock the power of these products."

3. “Products and experiences need to be adaptable and connected"

"It's critical to make it easier for customers to navigate rapidly changing landscapes and technologies," explains Sharanya. "You don't want the tools or the mechanisms you use to actually make your job harder because if they do, you are going to look for an alternative."

The Future of Finance Report 2023 identifies some more customer expectations and preferences within banking:

- Customers use more digital channels: 45% of consumers in Europe used digital channels to purchase banking products in 2023, up from 33% in 2020

- Customers want more personalization: 66% of consumers say they'll leave a brand if it doesn't provide personalized experiences

- Customers are open to sharing their personal data: 56% of consumers are open to sharing their customer data for a better experience

As Sharanya points out, "If businesses want to continue to stay competitive and be innovation leaders, they have to focus on these evolving customer needs."

6 Trends shaping customer experience in banking

With customer experience proving increasingly important in the financial services industry, banks need to ensure their services are easy to use and provide genuine value. Here are the top banking CX trends steering the future of finance.

1. Increased desire for high-quality mobile and digital banking

Mobile banking provides customers with the freedom to manage their finances anytime, anywhere—from checking account balances and transferring funds to paying bills and applying for loans. This level of convenience and accessibility is becoming essential as customers’ expectations evolve.

According to the World Retail Banking Report 2024, customers increasingly choose digital channels over in-branch visits. While 23% of customers still prefer branches for certain transactions, a shift is underway, with 37% using digital platforms to reduce their reliance on physical branches.

However, many customers aren’t fully satisfied. In fact, 59% rate their mobile banking experience as ‘average,’ highlighting a clear gap in digital service quality.

Sheila Maceira highlights the importance of mobile convenience:

Customers demand user-friendly digital platforms and apps for effortless banking. Our mobile banking app allows customers to seamlessly manage accounts, investments, and payments on the go.

Sheila Maceira

Head of Design for Everyday Banking (Savings) at a leading UK-based financial services group

Share

Knowing this, it’s no surprise that the industry has also seen a surge in neo banks—digital-only banks like Monzo, Starling, and Revolut, that provide a wide range of services, from checking accounts to budgeting tools.

These banks cater to the growing demand for instant interactions, offering customers the convenience of managing their finances on the go while meeting the expectations of a digitally driven world.

Power better mobile experiences

Design, test, and validate every part of your mobile experience with the Maze mobile app—from early prototypes to live app interactions.

2. Balance between self-service and in-person solutions

While banking consumers are increasingly willing to use digital services, 64% of customers report their mobile banking app doesn't allow them to solve their problems quickly, or even at all. And 39% of customers say poorly integrated chatbots are the primary cause of digital friction.

These numbers reflect that there's significant room for improvement in self-service platforms. However, it’s not just about providing better self-service options—customers still value human-to-human interactions and support via physical branches. In fact, 65% of GenZers say they prefer opening an account in person compared to 58% of Millenials, Gen Xers, and Baby Boomers.

“Many financial institutions imagined a world where everything was self-service. But that’s unrealistic, and it’s not good for business,” says Rob Vanasco, VP of User Research at Regions Bank.

The challenge now is knowing which self-service functions to offer and which to still provide in-person options for.

Rob Vanasco

VP of User Research at Regions Bank

Share

To put this into context, Rob gives an example of a bank that can offer personal loans online. “This offering is ideal for those who have had personal loans before. They should know what they are looking for and be comfortable going through the process independently,” says Rob.

“But personal loans can be confusing, especially when it comes to paying them back. Customers who are younger or have less experience might need help feeling confident about picking a personal loan and knowing how to use it.”

It’s about finding the right balance—and providing personalized options, which we’ll discuss shortly.

3. Omnichannel strategies for seamless customer journeys

Providing banking customers with a consistent omnichannel experience has never been more vital. In fact, 40% of customers won’t do business with a company if they can’t use their preferred channels.

Rob shares an example of a well-rounded customer experience. He says, “A customer might want to talk to a branch associate about personal loan options and even start the application process in the branch, but then be able to complete the application on their own at home using the bank’s website or mobile app.”

Banks have recognized that customers have different desires in different channels and want to either complete an experience all in one channel or have the option to switch channels without losing data or history.

Rob Vanasco

VP of User Research at Regions Bank

Share

4. Personalized experiences are key for retention

Over the years, demand for personalization has grown, with 70% of customers now wanting banks to offer personalized experiences and advice. This is especially true among younger generations—a key consideration as banks prepare to provide financial experiences and products to the incoming Generation Alpha.

However, this is often easier said than done—with the impacts of failing to do so more apparent than ever. Rob says, “Banks are still trying to figure out what a personalized bank experience looks like. If customers can't complete the tasks they need and can't connect with their bank when and how they want, they will look for a new bank.”

Discovering what customers truly want and need is crucial for forward-thinking banks and financial institutions. Tailored products and experiences are what sets banks apart from each other, and ensure that customer expectations are continually met.

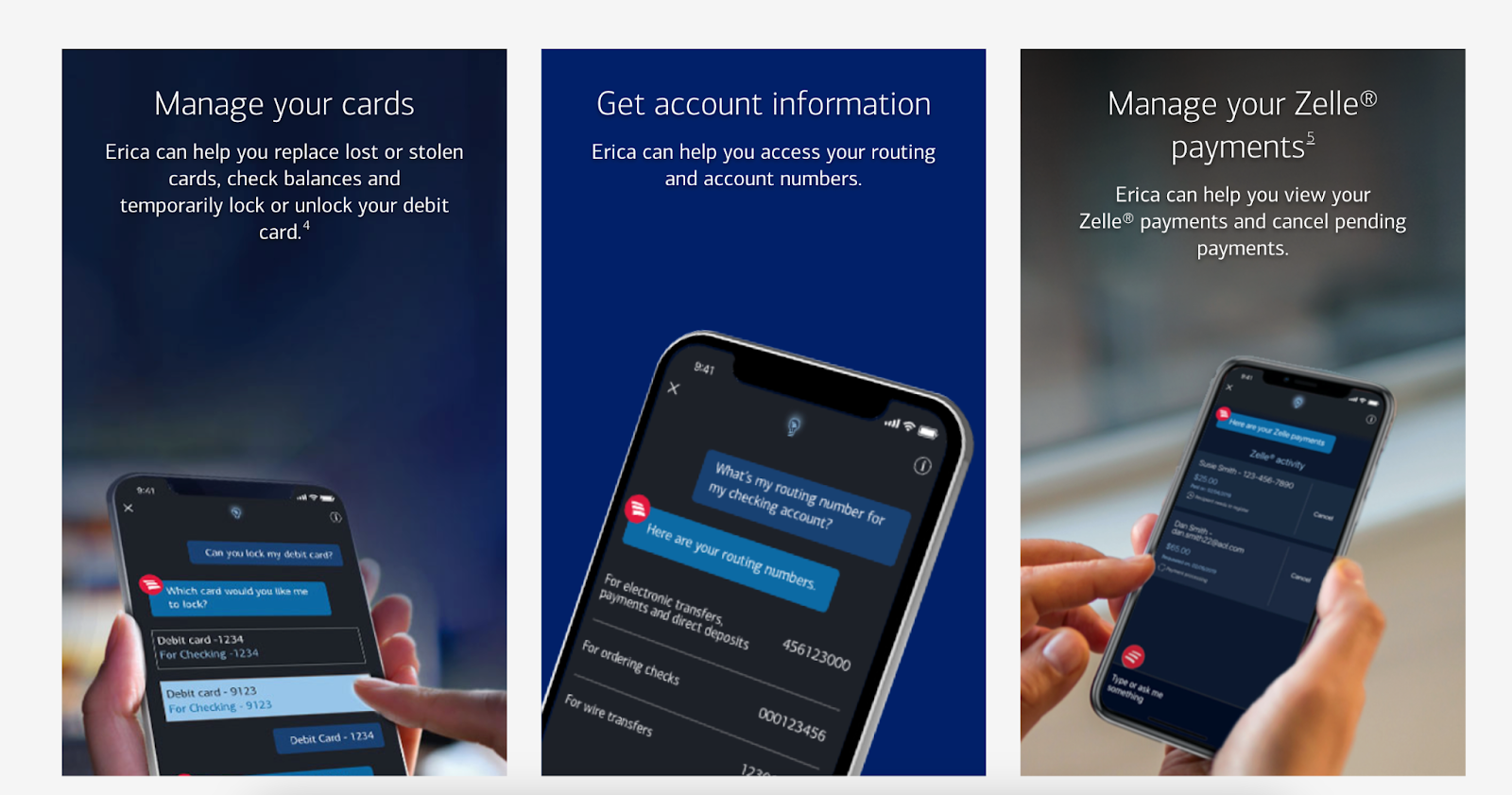

Bank of America's virtual assistant, Erica

For example, Bank of America’s virtual assistant, Erica, is designed to provide personalized support, helping customers manage their finances with ease. It offers proactive insights based on individual spending patterns, monitors subscriptions, and suggests ways to save. As of April 2024, Erica has completed over 2 billion interactions, serving more than 42 million customers with personalized experiences.

According to a report by The Harris Poll, nearly 60% of GenZers have noticed a positive impact on their financial habits or goals as a result of personalized digital banking services that understand and anticipate their needs and grow relationships with them. This positive experience translates to increased retention and revenue, highlighting the importance of personalized experiences.

5. Artificial intelligence for improved customer relationships

The market value of AI in finance is expected to grow to $37.15 billion by 2028, which comes as little surprise when you consider that 80% of bank executives see it as a major step forward in customer experience and operational efficiency.

And it’s not just bank executives that are on board with the shift. Nearly 70% of consumers are on board with using AI for advanced fraud detection.

There’s a great opportunity to personalize services based on user preferences, using AI to give investment recommendations that match customers’ financial goals and risk tolerance.

Sheila Maceira

Head of Design for Everyday Banking (Savings) at a leading UK-based financial services group

Share

A report by Deloitte notes that the top 14 global investment banks could improve their front-office productivity by 27% to 35% through generative AI—all while supporting superior customer experience and rapid innovation.

"By using AI, we can identify customer needs and preferences, and display relevant information at the right time," says Sheila. "This speeds up banking tasks and reduces friction. It also improves customer loyalty by providing a personalized experience."

Here are some ways banks can leverage AI:

- Self-service chatbots: They provide round-the-clock customer support, instant query resolution, and reduced wait time

- Creditworthiness assessment: Automated evaluation of loan applications to speed up the approval process and improve financial accessibility for customers

- Virtual Financial Advisors (VFAs): These AI-driven advisors offer on-demand, personalized financial advice around the clock to nurture a more informed and confident customer base

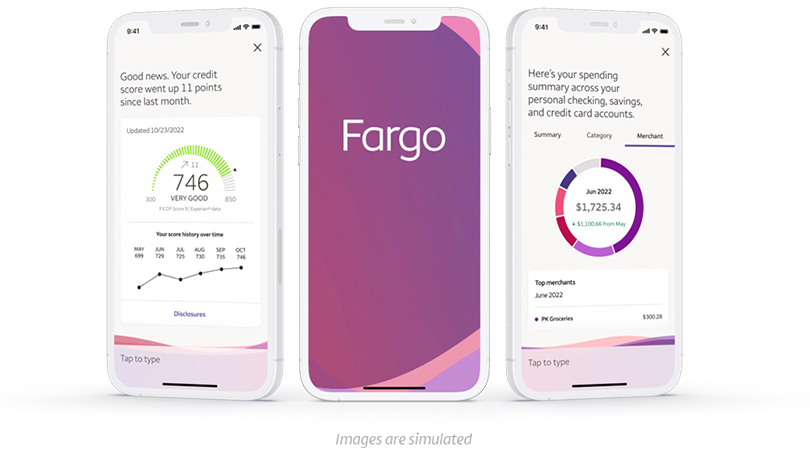

AI-powered banking app, Fargo

For example, Wells Fargo has integrated generative AI into its services through Fargo, an AI-powered virtual assistant within the Wells Fargo Mobile app. Launched in March 2023, Fargo uses Google's Dialogflow and PaLM 2 large language model to understand and process natural language in order to better support customers. Fargo has handled over 20 million customer interactions and is projected to reach 100 million interactions annually.

It’s not just the customer experience that can be improved by AI; organisations and employees also benefit from AI-powered processes. From task automation to AI-supported customer research, adding AI support to your workflows can increase productivity, efficiency, and accuracy.

6. The adoption of blockchain solutions

Blockchain is revolutionizing a wide variety of industries, with the financial sector leading adoption. The decentralized nature of blockchain technology offers a level of transparency and security unmatched by traditional retail banking systems.

Here are some of the ways these technologies are being used to optimize CX in banking:

- Payment processing and cross-border transactions: JPMorgan's Interbank Information Network (IIN) uses blockchain to cut friction in the global payment process, speeding up transactions and reducing costs

- Smart contracts: Banks like Barclays Bank and Standard Chartered have experimented with smart contracts to manage their claims process and other contractual agreements

- Asset management and tokenization: Tokenizing assets on a blockchain allows for fractional ownership and lowers barriers to investment entry. Banks like Fidelity are looking into using blockchain solutions for managing assets and creating tokens. This could make systems more efficient and secure.

These advancements reduce transaction times, lower costs, and introduce new investment opportunities, providing customers with a more flexible and modernized banking service.

How can banks improve the customer experience?

Providing an excellent customer experience starts with understanding your customers—what they think, feel, and expect. But more importantly, why they think, feel, and act in certain ways. User research is how you get to know your customers and optimize the banking customer experience based on their needs.

The best and only way to improve the customer experience is to understand your customers. The more you talk to them, learn their habits, and observe their actions, the better you can provide experiences that meet their needs. If a bank can do that, they will find themselves with very loyal customers.

Rob Vanasco

VP of User Research at Regions Bank

Share

Generative research, like user interviews, allows you to gather cutomer feedback and insights about their goals, expectations, and pain points. You can use this information to identify areas of improvement and focus your efforts on designing solutions that add real value to your customers.

Further research and testing, like usability testing, help pave the way for a product solution, ensuring it's easy to use and works as intended.

For example, let's say you provide customers with access to a mobile app for managing their banking needs—from day-to-day transactions to investing for the future. Yet, only 15% of customers who download the app use it to manage their banking.

So, you decide to ask why.

Through in-depth interviews and user feedback surveys, you collect customer data on what the issue could be. Some find it clunky, others prefer to handle their banking offline no matter what, but the main issue soon becomes crystal clear: customers don't trust the app.

They say the messaging is different to what they expect from your brand, and they therefore don't feel confident using it to manage their finances.

To find out what they expect, you conduct further research. This time, prototype testing holds the key to your users' wants and needs. You develop an updated interface with clear, on-brand messaging to take to users, and—by testing these prototypes and making data-backed tweaks—find that they're much more confident in the new app. The messaging puts them at ease, and you begin to see adoption climb. Congrats!

Conducting research might help you uncover that customers don't trust the app, as the messaging is different from what they've come to expect from your brand. Plus, you can test your onboarding flow and collect valuable feedback to optimize the user experience.

An established research process is key for understanding customer needs and meeting them in the most viable way. Rob offers some advice for banks starting their user research journey, "When working on future-state strategies, banks should assign key performance indicators to track progress. When you do X, you'll know you are successful because of Y."

"Creating a simple hypothesis like this can help banks identify where they have gotten it right and where they still have opportunities to improve. It's OK to fail if you know where and how you failed, which will lead to future success."

Happy customers, happy business

Step into the new age of customer-centric banking where customer experience is paramount to customer satisfaction and long-term business success. A better customer experience can help foster brand loyalty and trust, and ensure sustained growth and competitiveness in the evolving banking landscape.

Happy customers make for happy businesses—with banks that invest in optimizing CX enjoying greater customer satisfaction rates. High-quality customer experience can also lead to increased profits through cross-selling and up-selling, as customers already have faith in your brand, merchandise, and services.

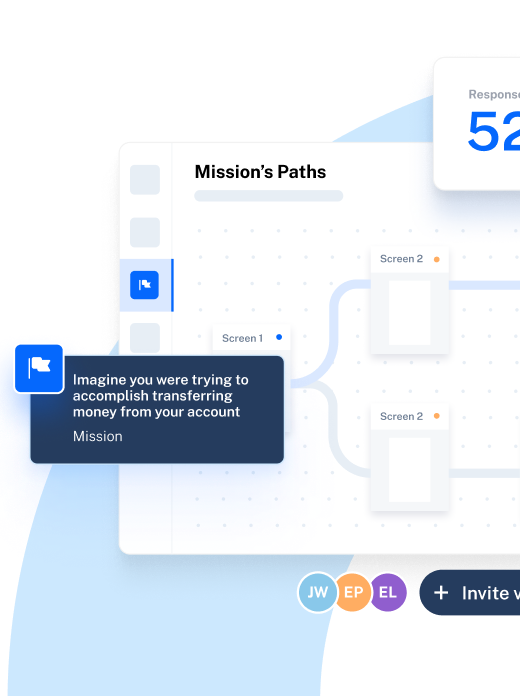

Your blueprint for a thriving bank in the modern world is just a decision away. With Maze, you can:

- Create continuous feedback loops with your customers to better understand their needs and expectations

- Test prototypes and optimize live websites to make sure your digital solutions resonate with your customers

- Generate automated reports and invite stakeholders to collaborate, ensuring customer-centricity is at the heart of all your initiatives

What are you waiting for?

Frequently asked questions about customer experience in banking

What is customer experience in financial services?

What is customer experience in financial services?

Customer experience in financial services refers to the impressions and interactions customers have with a financial institution across various touchpoints. It focuses on three key aspects: usefulness, ease of use, and enjoyment.

Why is customer experience important in banking?

Why is customer experience important in banking?

Customer experience is the crucial differentiator that sets banks apart in today's competitive landscape. Banks that provide a great customer experience retain more customers and build brand loyalty.

What is an example of good banking customer experience?

What is an example of good banking customer experience?

Examples of good customer experience in banking include:

- Erica: Bank of America's AI-powered chatbot for easy transactions, fund transfers, deposits, and financial advice

- Bconomy: BBVA Spain's app feature helps customers set financial goals, save money, and track progress

- HSBC UK: Their new investing feature allows younger clients to invest in themed portfolios based on their preferences and values