In the past year alone, 25% of customers switched banks, and over a third switched their insurers and wealth managers—citing the desire for a better digital experience as their number one reason for changing providers.

As customer expectations evolve, financial organizations that prioritize delivering a superior customer experience are poised for success.

However, improving CX isn't a one-off task. Adopting a continuous-learning mindset is vital to understanding your customers' financial journey, their motivations and concerns, and adapting to their shifting needs.

In this article, we'll explore how customer expectations are changing and what you can do to deliver superior experiences that foster lasting relationships and drive a competitive advantage in the financial services industry.

Why is customer experience in financial services important?

Traditionally, financial institutions focused on differentiating themselves through the products and services they offered. But in today's dynamic landscape, if you bring new initiatives into the marketplace, it's only a matter of time before similar offerings become available and reduce your competitive advantage. Customer experience has emerged as the key differentiator for financial services.

Modern customers seek more than just the service itself. They look for a provider that understands their needs and can offer a seamless, engaging experience across all touchpoints—from sign-up and onboarding to executing transactions and reaching customer support.

Banks have transitioned much like software companies, focusing on refining and enhancing customer experience after overcoming initial technological challenges. Now, differentiation is less about execution and more about positioning, branding, and ensuring the offerings align with the right customer needs.

Benjamin Humphrey

CEO and co-founder of Dovetail

Share

By taking steps to build more meaningful personal relationships and better experiences, banks could boost revenue from primary customers by up to 20%. When you prioritize customer experience, you pave the way for a deeper understanding and fulfillment of your client's wants, needs, and goals.

Overall, a positive customer experience can help:

- Build trust through transparency in fee structures, accurate information, and secure transactions

- Improve customer retention by gathering customer feedback often, addressing any issues promptly, and ensuring accessibility to services

- Create competitive differentiation through personalized experiences, omnichannel interactions, and innovative product offerings

- Increase operational efficiency with new technologies like AI-powered chatbots or mobile banking apps that reduce wait times and operational costs

- Drive revenue growth as satisfied customers are more likely to opt for additional products or services, creating cross-selling or up-selling opportunities

- Uplift brand reputation through positive reviews and ratings, attracting more customers and partnerships that are crucial for long-term success and sustainability

What do customers expect from their financial services experience?

Digital transformation and the entrance of new players into the market, like fintech companies and neo-banks, have disrupted the financial services sector—introducing more user-friendly versions of traditional financial products and raising the bar for customer experience.

Whether it's applying for a debit card, opening a savings account, or renewing coverage, customers expect a superior, frictionless, and personalized experience. However, only 21% of banking customers and 27% of wealth management customers state they're completely satisfied with the digital experience offered to them.

According to Benjamin Humphrey, CEO and co-founder of Dovetail, there's been a notable shift in the financial sector towards creating a more user-centric model.

While bank offerings remain largely the same, the emphasis on brand and user experience has grown.

Benjamin Humphrey

CEO and co-founder of Dovetail

Share

So, what are customers expecting from their financial services experience? Here are some key trends and stats from The Future of Finance Report:

1. 88% of consumers prefer to bank online, either through a mobile app (59%) or a desktop browser (29%)

The digital revolution in financial services hasn't only changed how customers interact with financial institutions but has also raised their expectations.

Customers have become more informed and tech-savvy, and they expect these platforms to be intuitive, easy to navigate, and efficient.

2. 93% of customers say they want their bank to "know me and my banking needs,” while 89% want their bank to offer useful financial advice

Today's customers want their financial services providers to offer personalized solutions, know their needs, and offer help and guidance.

3. 56% of customers are open to sharing their data in exchange for a better experience

Increased awareness of personal data security has made trust between providers and customers more crucial than ever.

Customer data is necessary to personalize experiences. Still, customers expect a clear explanation and a sense of control over what data is shared, who has access to it, and how the data is used.

Customer experience challenges in financial services

Now that we've discussed what your customers expect, let's delve into the unique challenges the financial services industry faces in meeting these needs.

1. Delivering omnichannel experiences

Customers expect a smooth experience, regardless of where and how they interact with your organization. The challenge lies in ensuring different channels, from online to in-person and mobile interactions, co-exist to offer a consistent and unified experience. Yet, with nearly 51% of customers being frustrated with inconsistent digital interactions—there's still ample work to be done.

Clients need to self-serve in their space and on their preferred devices. Know your client through research, dive into their data, and build solutions that engage them for the right reason at the right time in the right space.

Dylan Brits

Client Experience Designer at Capitec Bank

Share

2. Protecting customer data

Your customers trust you with sensitive information, including financial records, identification data, and transaction histories. While automation, like chatbots and AI, enhances user engagement and service efficiency, it also brings new possibilities for cyber threats.

42% of organizations say their top customer engagement challenge is finding a balance between security and customer experience. Any lapse in data security can lead to a damaged reputation, financial loss, and legal action. In a heavily regulated industry such as financial services, balancing CX with the need to comply with these regulations and protecting customer data is a foundational trust-builder.

3. Breaking down organizational silos

Financial institutions include many products, services, and departments. Organizational silos create barriers to collaboration and information sharing, leading to fragmented decision-making and disconnected experiences. Removing these obstacles is vital to providing the seamless digital experience that financial services customers want and need.

More often than not, it's usually internal processes that hinder true innovation transformation. The bigger the organization gets, the harder it becomes to have visibility and transparency across different lines of business and different teams.

Sharanya Ravichandran

VP of Design at JPMorgan Chase

Share

Now, with these limitations in mind, let’s consider how you can go about improving the financial services experience for your customers.

6 Ways to improve customer experience in financial services

Improving customer experience is about deep-diving into all aspects of your products and services and tuning them to the needs of your customers. Here are six actionable areas you can focus on to ensure a solid CX strategy that meets—and even exceeds—your customer's expectations.

1. Get to know your customers

Digital transformation should always start and end with the customer.

Sharanya Ravichandran

VP of Design at JPMorgan Chase

Share

Understanding your customers is crucial for successful customer experience optimization. Product development within financial services—and any industry, for that matter—should never be based on what you think customers want.

With generative research, you can develop a deeper understanding of your customers' motivations, pain points, and expectations. This helps you identify the right problem you want to solve and gather the evidence needed to move forward confidently.

2. Visualize the end-to-end customer journey

Map out every touchpoint your customers interact with—from the moment they become aware of your platform to when they either complete a transaction or choose to exit. By mapping out the customer journey, you can get a holistic view of the entire customer experience with your services and products and see what you need to optimize.

This is an ongoing effort that requires cross-functional collaboration, collecting customer input, and the willingness to adapt based on insights gained.

Here's how you can go about it:

- Identify customer touchpoints like website, mobile app, contact centers, branches, and more

- Capture feedback through surveys, social media, or interviews to see how customers feel about their interactions with your business

- Use analytics tools to get data like common drop-off points or stages where customers face issues

- Create customer personas and group your audience based on behavior patterns, goals, and attitudes

- Continuously monitor customer interactions and feedback to understand their evolving needs and concerns

3. Build a customer-centric culture

Customer-centricity puts the customer at the heart of every decision, strategy, and interaction. Involving customers continuously throughout the product development process leads to better experiences optimized with customers' wants, needs, and goals in mind.

UX research creates better solutions, better solutions create better wins, and better wins create better team cohesion.

Dylan Brits

Client Experience Designer at Capitec Bank

Share

Plus, it's not just the customer experience that benefits from a customer-centric approach. The 2023 Research Maturity Report shows that companies that leverage research at their highest potential achieve 2.3 times better business outcomes than those with low-maturity practices. These include 4.3X faster time-to-market, 4.2X increased revenue, and 3X improved brand perception.

Here are some best practices for building a customer-centric culture:

- Educate and involve key stakeholders: Explain the importance of a customer-centric approach and share examples of how it improves customer satisfaction and business success

- Embed UX research into your processes: Conduct evaluative and generative research throughout the product lifecycle to ensure you continuously meet customer needs

- Make evidence-based decisions: Build a knowledge management hub for all research reports and learnings to ensure you base decisions on customer feedback and data

4. Provide a highly personalized experience

The transition from in-person to online banking and digital payment methods demands a fresh approach to delivering personalized experiences that build trust, enhance satisfaction, and foster long-term relationships.

Here are some strategies to consider:

- Prescriptive personalization: Leverage historical data, algorithms, and predictive analytics to offer personalized recommendations or actions, like an investment strategy based on customers' financial goals, risk tolerance, and the current economic environment

- Real-time personalization: Instantly deliver customized content to individual customers in response to their interactions with your brand, driving engagement and conversions

- Machine-learning personalization: ML algorithms analyze large and complex datasets to identify trends, allowing you to automate decision-making based on individual customer behaviors

5. Leverage emerging technologies

The digital landscape is fast-paced and ever-changing, and providing an optimized customer experience requires that you stay up-to-date with the latest technologies and CX trends.

In the 2023 CIO Agenda Report, Gartner found that 21% of enterprise businesses within the banking and investment industry consider improving the user experience their top priority—and plan to increase funding for total experience solutions from 35% to 42% in 2023.

According to the report, artificial intelligence (AI) is the technology most likely to be implemented by 2025, followed by distributed cloud and machine learning operations.

6. Foster continuous research to optimize experiences

Continuous research provides valuable insights into customer behaviors and expectations across all customer journey stages. This data can be used to further refine the onboarding process, simplify transactions, and encourage positive referrals.

Here's how you can adopt a continuous research mindset:

- Run product discovery to uncover your customers' wants and needs in order to validate ideas and inform your product strategy

- Collect feedback by running surveys or interview studies to continuously generate customer insights and plan future research and development

- Use analytics tools to identify actionable insights like common pain points or areas of improvement

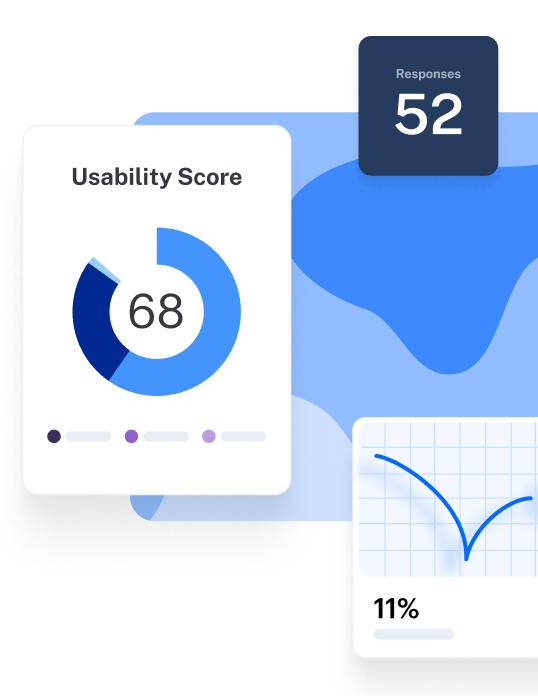

- Conduct evaluative research—like usability testing, tree testing, and A/B testing—to learn how users interact with your product, identify pain points, and optimize the user experience

- Encourage collaboration across Marketing, Sales, Customer Support, and Product Development teams for shared learning and insights

Explore real-life examples

Learn how Bpifrance used Maze to increase research efficiency, halve time-to-insight, and improve their product designs based on user feedback. Read the case study now.

Elevate CX in financial services with Maze

Improving customer experiences isn't a one-off task but a continuous journey. It's about tuning into your customers' needs and meeting them with quality and excellence at every touchpoint.

An optimized customer experience can help build trust, provide a competitive advantage, and increase customer loyalty—ultimately leading to increased revenue and a stronger brand reputation.

With a continuous product discovery tool like Maze, you can create intuitive, user-friendly experiences that resonate with your customers.

- Run expert-level research using a breadth of methods, including prototype testing, interview studies, and website testing—all in one platform

- Recruit from a diverse panel of participants and collect high-quality responses to shape and speed up your decision-making

- Simplify complex financial product research and gather insights while staying fully compliant

Financial services customers are demanding more from their customer experience, and they're switching when they're dissatisfied. The future of finance is here—make sure your financial services company isn't left behind.

Frequently asked questions about customer experience in financial services

What is customer experience in financial services?

What is customer experience in financial services?

Customer experience in financial services is how customers engage and feel about their interactions with banks, investment firms, or insurance companies. It covers every touchpoint—from online platforms and mobile apps to in-person branches and customer service channels.

How can financial services improve customer experience?

How can financial services improve customer experience?

Financial services can improve customer experience by:

- Fostering a customer-centric culture that puts customers at the heart of every decision and process

- Understanding the customer's financial journey, collecting feedback, and using insights to enhance the experience

- Using data analytics to tailor services and interactions to individual customer preferences and needs

- Rewarding loyal customers with incentives to increase satisfaction and retention

What are examples of customer experience in banking?

What are examples of customer experience in banking?

Some examples of great banking customer experience are:

- Including chatbots for a self-service, personalized experience—like Erica, Bank of America’s app-based chatbot

- Implementing appointment scheduling technology to reduce wait times and improve service—like Rogue Credit Union's appointment scheduling feature

- Addressing customers' unique banking needs and help them achieve their goals—like JPMorgan Chase's banking client experiences