You’ve got a brilliant idea for a new product, and you’re equipped with the knowledge and skills to turn it into a reality. Nothing’s standing in your way…right?

Before you put your money where your mouth is, you need to validate your idea to justify investing in it. You might think it’s a great product, but have you checked to see if the market does? Are you sure that people are going to use and pay for this product?

To discuss this process—known as market validation—we spoke to Malte Scholz, Head of Product and CEO at airfocus, and Martín Burgener, Product Director at eDreams. They shared their insights on all things market validation—from why you need it, to their own experiences validating product ideas.

Let’s get into it.

Market validation: Quick overview

Market validation is an essential step in the product development process between having a new product concept and starting the process of creating it. It involves conducting qualitative research and data analysis to assess the viability of a product or business idea within the target market.

Market validation can be used when developing a startup idea centered around an innovative new product, launching a new product within an existing business, or developing a new feature to add to current products.

Why you should do market validation

Undertaking a market validation project is hugely beneficial for two main reasons:

- It helps avoid big product failures

- It helps secure and justify funding for product development

1. It helps avoid big product failures

Developing products takes a lot of time and financial investment. So, when those products are created and launched but fail to attract users in the target market, the sunk cost can be significant.

Market validation helps to avoid these situations by making sure you understand your users, and that you’re not building a product that no one wants or needs.

Everything starts and ends with the product. We can do as great sales and marketing as we want, but if we don’t get the product right, we’ll fail.

Malte Scholz

Head of Product and CEO at airfocus

Share

To look at it a different way, market validation research also helps you to create a better product by more accurately fulfilling users’ pain points. During the market validation process, you’ll gain an understanding of your users’ needs and pains through qualitative and quantitative data analysis. These insights will inform a product team on what products or features will best bring value to users.

2. It helps secure and justify funding for product development

The reality of developing new products is that it costs money. By undertaking a market validation process, the viability of the product’s success can be more accurately determined. This makes investment in its development far easier to acquire and to justify in the eyes of stakeholders.

For example, a startup will likely have a short window of time after founding and before initial funding becomes necessary to continue growing.

A team within an existing company will have to justify the cost of the new product before it’s given the green light by the company’s management.

Even a solo entrepreneur creating a product on their own will have bills to pay and limited hours in a day. So before they invest their time into building the product, market validation can assure them of their product’s viability for success—or it can help them avoid spending months on a product unlikely to succeed.

Our company succeeds when we nail the product, and that’s why product validation and product-market fit are so essential to us.

Malte Scholz

Head of Product and CEO at airfocus

Share

In each of these scenarios, investing time and money into a product is an enormous risk. So, before resources can be allotted to development, market validation helps to justify the investment by confirming the existence of a target market willing to buy the product.

5 Steps for successful market validation: The process

The process of running a market validation test can vary a lot, depending on your resources, the type of product you’re developing, your industry, and the demographics of your users. But, there is a solid framework in which most market validation processes can work.

A standard market validation plan includes:

- Defining goals, assumptions, hypotheses, and target customers

- Assessing market size and competitive landscape

- Developing your test and questions

- Finding research participants

- Conducting the experiment and analyzing findings

Step 1: Define goals, assumptions, hypotheses, and target customers

Only with a goal and a hypothesis, or assumption, in mind can you start the market validation process. After all, this process is about testing assumptions relating to market viability with real users of your product.

Start by writing down the assumptions you want to test first. The best place to start is the assumptions that are the most critical to the overall success of the product.

My boss here at eDreams has an example: If you build a chair, and one of the screws is not strong enough, then the whole chair will break. So you first have to test the screw itself.

Martín Burgener

Product Director at eDreams

Share

Some examples of vital assumptions to test could be:

- There’s demand in the market for this product

- Our target demographic will want to use the product

- The product will solve the needs of its users

- Our pricing model suits our target customers

Step 2: Assess market size and competitive landscape

Now you’ve established key assumptions, the next step is to assess the market size and competitive landscape. This product analysis process helps you determine whether there’s sufficient demand and opportunity for your product to succeed, and provides essential context for designing effective validation tests.

- Begin by defining the total addressable market (TAM), which represents the overall revenue opportunity available if the product were to reach its maximum sales potential.

- To refine this further, consider the serviceable available market (SAM), which is the portion of TAM you could realistically target with your business model.

- Finally, focus on the serviceable obtainable market (SOM), which is the portion of SAM you can realistically capture with your product in a specified timeframe.

Utilize both top-down and bottom-up approaches to estimate these figures:

- The top-down approach starts with broad industry data and narrows down to your specific segment

- The bottom-up approach builds an estimate based on user adoption rates and potential customer base calculations

Both methods require thorough market research, including industry reports, market analysis studies, and custom online surveys or focus groups to gather relevant data.

Tip ✨

Most survey tools, including Maze Feedback Surveys, allow you to easily create and customize product surveys, share them with your audience, and access results quickly.

Next, analyze the competitive landscape to understand market dynamics. Identify direct and indirect competitors, evaluate their positioning, differentiation, pricing, and market share. Tools like SWOT analysis can help assess their strengths, weaknesses, opportunities, and threats.

Understanding market size helps validate whether the opportunity is large enough to justify pursuing, while competitive product analysis tests assumptions about differentiation and defensibility. It also shows you key competitors to monitor and potentially learn from during validation, making it a crucial part of the market validation process.

Step 3: Develop your test and questions

Once you’ve assessed the market size and competitor landscape, you'll need to choose a research method that best tests your assumptions. The most common market validation methods are customer interviews and surveys.

In this step, you also want to create the test itself. For interviews and surveys, you can now decide on what research questions to ask prospective participants. If you’re not sure where to start, check out the Maze Question Bank—our free collection of 350+ ready-to-go research questions.

Once you’ve developed the questions, it’s good practice to put it through a dry run. For this, you should simply ask someone to go through the test with you. At this stage, representative users aren’t important, as you’re just testing if the test itself will make sense in the real experiment.

In addition to writing research questions, consider creating a testing script. This script serves as a detailed guide for conducting in-depth interviews and surveys, so each interaction remains consistent and focused on the objectives of the test.

It typically includes the introduction, exact questions or tasks, expected actions from participants, and any follow-up questions that might help delve deeper into the user's experience and thoughts. Test scripting standardizes the data collection process and helps reduce variability in responses, making your insights more reliable and actionable.

Step 4: Find research participants

An essential part of any type of research is recruiting research participants, but 60% of businesses cite recruiting the right participants as one of the biggest challenges they face during user research.

First off, these participants need to be representative of the actual users you’ll be targeting for your product. Without representative test users, the feedback you’ll get will be biased in unrealistic directions.

You may need to offer incentives to convince people to take your experiment. If you require the participants to be physically present, then you may also want to cover their travel costs. For other experiments, you could offer a free trial of your product once it’s released.

💡 How many test participants should you include? Consider including 15-30 participants for qualitative insights and 30+ for quantitative data.

There are several ways to recruit research participants for your market validation test, from using your personal network to posting on social media, existing product users to employing guerrilla testing methods. You can also use purpose-built tools, like Maze Panel, to source your ideal participants. Maze’s Panel enables you to filter and your search and screen participants to ensure you get the perfect users, taking the stress out of participant recruitment.

Once you’ve recruited your research participants, keep track of them, whether it’s through a spreadsheet, virtual rolodex or tool like Reach. Reach is your own tailored participant database that enables you to understand and improve participant engagement. Think of it as a CRM for research participants.

Step 5: Conduct the experiment and analyze findings

At this point, you are ready to actually run the experiments. You know the assumptions you want to test, you’ve chosen an ideal method of conducting the test, and you’ve recruited enough participants to get useful feedback.

As you conduct experiments, you'll gather both quantitative and qualitative data:

- Quantitative data comes from metrics like survey ratings, competitor usage statistics, or any numerical data that indicates how users feel about your idea and similar products. Review quantitative data using analysis methods like statistical analysis to understand central tendencies, correlation analysis to identify relationships between data points, and variability analysis to assess the range of opinions.

- Qualitative data includes detailed responses from interview transcripts, open-ended survey questions, or online comments. It provides rich context that numeric data cannot. Analyze qualitative data using techniques like thematic analysis to identify common themes.

Both types of data offer valuable insights—qualitative data helps you understand the ‘why’ behind user behaviors, while quantitative data reveals patterns and trends across your sample. You should aim to gather a mix of both for a clear picture during your analysis.

When analyzing your findings, remember that having your assumptions proven wrong is not a failure, but rather a natural part of the validation process. As Martín explains, market validation is about proving your assumptions wrong time and time again until you get the idea right:

If we think about the products eDreams have been working on, roughly 70-85% of all tests we do result in a fail. And that’s for a company that is product-led and has been making digital products for 12 years.

Martín Burgener

Product Director at eDreams

Share

It’s important to see failure as part of a successful experiment rather than something negative itself. Having assumptions being proven wrong is inevitable, so the better mindset is to consider them a regular part of testing.

This also fits as part of broader advice: stay humble. Product teams should never assume they really know what users need and want. Keeping a mindset of humility, and assuming you never already know the answer, means always listening to the customer.

It all goes back to: be humble and learn more than explain.

Martín Burgener

Product Director at eDreams

Share

Market validation is not a one-off test. Rather, it’s a process that should continue all through product development. Humility during this process can not only help product teams stay positive in the face of setbacks but nearly always lead to better product development.

Market validation methods

There are many different approaches to market validation, and each has its benefits and drawbacks. It’s important to make sure you use the right methods, and often that means using a combination of multiple methods to get a more complete view of the market.

To us, it’s not a one-structured approach to validating the market. It’s a lot of things that come together, like data collected from user interviews, usage data, experiments, MVP data.

Malte Scholz

Head of Product and CEO at airfocus

Share

Below, we’ll take a look at some of the more popular market validation methods:

- Online surveys and customer interviews

- Building a minimum viable product (MVP)

- Prototype testing

- Usability testing

- Search Engine Results and Google Trends

- A/B testing paid ads

Online surveys and customer interviews

Running customer interviews and conducting user surveys are popular and effective ways of doing market validation tests, largely due to the in-depth data gained from customers’ feedback. These market validation methods of research are very flexible, allowing you to learn about your users from many different angles.

With a bias-free survey or questionnaire, you get the benefit of a huge volume of responses, while interviews allow you to dig deeper into people’s feedback and uncover their true problems.

There’s always quantitative stuff you can do, like statistics and market analysis. But, at the end of the day, the most important part is to get qualitative feedback by talking to people.

Malte Scholz

Head of Product and CEO at airfocus

Share

Involving a Customer Advisory Board (CAB) takes this process a step even further. CABs are a group of users who meet with a company regularly to offer feedback and advice on their product development. They help product teams to challenge biases and assumptions of what users need and want, and are invaluable in more deeply validating a new product.

💡 Run better research with Maze AI

Maze’s AI-powered research solutions enable you to get insights faster. From using AI to automate follow-up questions in user surveys, to getting AI-generated summaries from user interviews—Maze’s leading user research platform makes validating products and ideas a breeze.

Building a minimum viable product

A minimum viable product (MVP) is the most basic version of your intended product, that still offers value to the user.

MVPs are often used for market validation to test the level of interest users have in the product and how they interact with the product itself. If users show continued use of the MVP, then it justifies investing in creating the fully-fledged version of the product itself. It also allows you to get feedback from your target audience and detect any major issues with how they’re using it.

The choice of whether or not to create an MVP often comes down to what it takes to create it. If you’re creating your company’s flagship product, then it makes a lot of sense to make an MVP to start bringing in revenue while the product is still being built. For additional products, if it’s going to take a year to create even the MVP version of your product, and you’re aiming for a lean process, then it may be better first to validate user interest in the product in other ways.

Sometimes it’s cheaper to build something than to test it with surveys. Some products are not hard to build, so they’re cheaper and faster than spending weeks testing. So it depends on the risk of assuming things and what it would cost you by failing.

Martín Burgener

Product Director at eDreams

Share

A common argument against creating an MVP is the time and financial investment it requires to build. A workaround solution, which still allows for lean market validation, is Wizard of Oz testing.

"We sometimes do what we call “Wizard of Oz”. This is where the user thinks the site is doing something, but really there’s a person behind doing it. It’s not a long-lasting solution, but it allows us to measure and validate if the value is there. Then we say, okay it makes sense to build an API because there’s a market there," explains Martín.

This tactic allows you to offer a service to your users without having to build a product to do it automatically. The main drawback is that it does require you to have staff on-hand who can pick up these tasks. However, if this feature is a paid one, the cost of the employee can be offset by the income of the feature itself.

Prototype testing

Prototyping can function as an invaluable tool for market validation, primarily because having a working version of your intended product allows for more robust product testing.

Prototype testing allows your users to interact with a low-fidelity version of your product and can unlock better insights into what works and what doesn’t. It means people aren’t imagining a product explained to them in words. Instead, they get to actually use the product, and better imagine themselves using it outside of the test.

Having a prototype also allows for usability testing. Working on a real, albeit early-stage, product with usability testing tools can give vital early feedback on the product’s design and UX, helping to create a better product down the line.

Maze makes prototype testing simple, with a purpose-built Prototype Testing solution that enables you to import prototypes from AdobeXD, Figma, Marvel, and more. Simply build your prototype, import your design to Maze, and run quick and insightful prototype tests to validate concept ideas.

Usability testing

Usability testing is about getting users to interact with your digital product by completing pre-determined tasks while taking note of their decisions and reactions. This type of testing lets you see if your product is easy to understand and use for prospective customers.

“At eDreams, we have what we call Wednesday Labs. We invite 6 people to our offices and we present a new project for them to navigate and test if they can get from A to B. That’s more qualitative than quantitative, but it allows us to test many things,” says Martín.

Market validation can benefit from usability testing because it allows potential users of the product to interact with it, while also giving their thoughts on the product itself and helping you to identify issues with ease of use and functionality.

This method is particularly useful if you’re conducting market validation for a new feature on an existing, proven product. You can include the new feature within the digital product the user is already aware of and test their responses to the new feature.

💡 Maze supports testing throughout the product development lifecycle

From beta testing to post-launch. With Maze’s Live Website Testing solution, you can observe real-time interactions from users—helping identify navigational difficulties, design flaws, or functionality issues that may not be evident in controlled test environments.

Search engine results and Google Trends

An easy way to gauge possible user interest in your product is by taking a look at online search results. This method involves seeing how many people are searching for particular phrases online each month with tools like Semrush or Ahrefs.

For example, let’s say your product idea is to create an online learning platform for people with autism. You could search for “e-learning” and “online video classes” to gauge the popularity of your industry and product, and then “online video classes for people with autism” to see how many people are already looking for your product.

The benefits of this method are that it’s a very quick and cheap method that gives you a general idea of the existing market interest in your product. You can even geolocalize results to see if there are countries with particular interest.

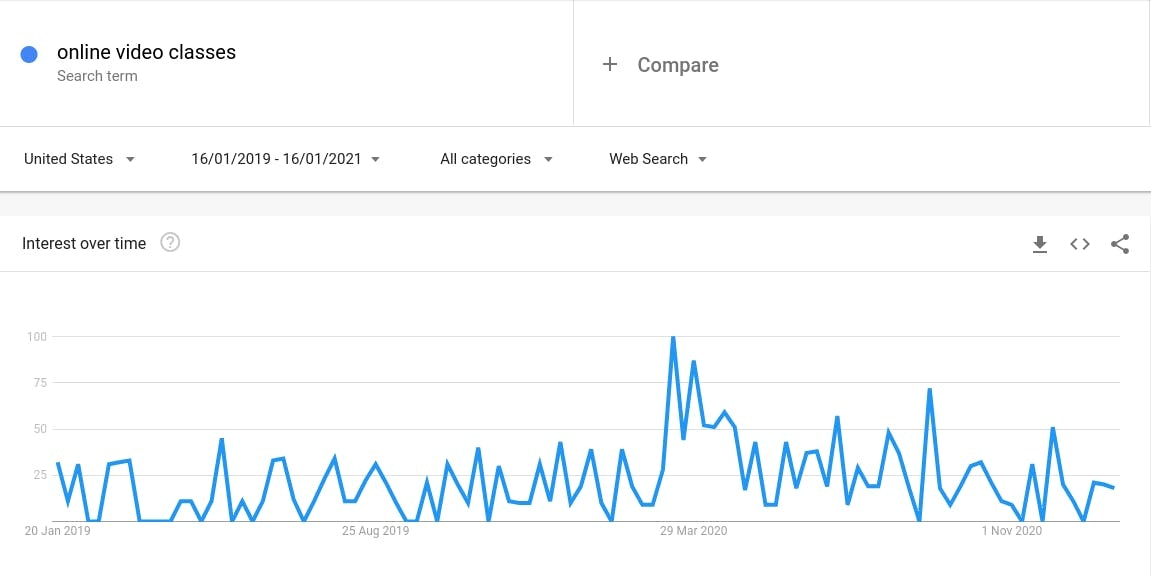

Another similar method is looking at Google Trends. This free tool allows you to see search patterns over time for particular keywords. While tools like Ahrefs and Semrush give numerical search volumes, Trends shows how search intent changes over a given period of time. For example, the Trends graph below shows a clear spike in interest for “online video classes,” coinciding with the start of lockdown measures imposed due to the 2020 Coronavirus pandemic. Seeing that your proposed product is steadily gaining in interest can help to validate it.

Google Trends results for "online video classes"

A/B testing paid ads

Finally, another market validation method is to A/B test online ads highlighting different aspects of your product. The point here is to see how much your users value particular product features, which can give insights on where future product development should focus.

Martín explains: "We sometimes do fake ads for Search Engine Marketing (SEM) tests. We compare a campaign that says 'The cheapest flights' and another that says 'The cheapest flights with free cancellation'. When you click, you get to the normal eDreams page, so if you see that the click-through rate is better for the second one, you see there’s value for 'free cancellation'."

A/B testing prototypes can be used in tandem with other research methods. For example, if you are running a Wizard of Oz test for a proposed new feature, then online ads can simultaneously be run to highlight the new feature. If there’s a clearly higher click-through rate for the ads with the new feature, then it validates the development of the feature as a digital product.

Real-world market validation example: eDreams

For eDreams, market validation was essential while they were working on a project focused on offering flexible flight tickets. This came with several assumptions. They first tested if their target customers valued free cancellation on their tickets at all. While in theory, it seems like an obvious advantage for travelers, the assumption still needs to be tested.

After conducting market validation tests, they found that despite it being a big trend in their industry, customers didn’t initially see the value of flexible tickets. “We tested if people valued flexibility. The first reaction from people was ‘I’m paying this because I want to go to Rome, why would I want to cancel?’ So, it took us a lot of iterations and work to get people to understand the value of flexibility, like if your boss doesn’t approve your holidays, or if you get sick, or if there’s a worldwide pandemic,” said Martín.

eDreams worked to better explain the value of the flexible tickets and found that, with the correct context, explanation, and phrasing, these potential customers were indeed very receptive to the idea and did value flexible tickets.

These results are interesting and indicative of the value of market validation. Asking open-ended questions and listening to customers allowed eDreams to see that there was value in offering flexible tickets, but that it was unlikely to be successful in the way they initially planned to present it to customers.

📚 Hungry for more? Read about real-life examples of usability testing implementation on our blog.

Market validation mistakes to avoid

There are several traps businesses can fall into when conducting market validation, which lead to inaccurate insights and poor decision-making.

Relying solely on secondary research

While market reports and industry data collected during competitive analysis provide valuable background information, they should not be the only source of validation. Primary research, like customer interviews and surveys, is essential to understand the specific needs and preferences of your target market.

Asking leading or biased questions

When conducting customer research, it's important to ask neutral, open-ended questions that don't steer participants toward a particular answer. Leading questions can steer participants, rather than uncover genuine customer insights.

Overemphasizing positive feedback

It's natural to focus on positive comments from customers, but ignoring or downplaying negative feedback can give a skewed picture of market reception. Watch out for cognitive biases influencing how you report on the data, and focus on looking for patterns in both positive and negative responses to identify overarching sentiments.

Failing to segment your market

Treating your target market as a monolithic group can mask important differences in needs, preferences, and behaviors. Segmenting your market based on key characteristics (e.g. demographics, psychographics, buying behaviors) can help validate your product’s relevance to the most promising target segments.

Overestimating market size or growth potential

It's easy to get caught up in optimistic projections, but inflating your market size or growth potential can lead to unrealistic expectations and poor planning. Use multiple, reliable data sources and be conservative in your estimates. It’s better to underestimate than overestimate!

Keep these considerations in mind and you’ll be one step closer to effectively validating product ideas with your target market.

Empower your researchers to perform market validation for your research project

Conducting effective market validation requires a strategic, customer-centric mindset that prioritizes learning and iteration over assumptions and gut instincts. From surveys and customer interviews to A/B testing and market analysis, each approach to validating ideas offers unique insights that can help shape the direction of a product or service.

If your needs include concept and idea validation, wireframe and usability testing, moderated interview analysis, and more—give Maze a try. Maze helps you get user insights fast, helping teams make data-informed decisions. With its intuitive interface and wide range of testing capabilities, Maze empowers teams to validate ideas, test prototypes, and gather valuable feedback at every stage of the product lifecycle.

Frequently asked questions about market validation

When should market validation be conducted?

When should market validation be conducted?

Market validation should be conducted at multiple stages:

- Ideation: Validate the product concept and assess market demand

- Development: Test prototypes and gather user feedback for iterative improvements

- Pre-launch: Confirm product-market fit and refine go-to-market strategy

- Post-launch: Monitor product performance and identify optimization opportunities

Continuous validation throughout the product lifecycle ensures alignment with customer needs and market dynamics.

What are the benefits of market validation?

What are the benefits of market validation?

The benefits of market validation include:

- Reduced risk of product failure

- Increased customer-centricity and satisfaction

- Data-driven decision-making for product development and marketing

- Identification of competitive advantages and differentiation opportunities

- Optimized resource allocation and faster time-to-market

What can market validation tell us about our customers?

What can market validation tell us about our customers?

Market validation provides essential insights into our customers' needs, preferences, and behaviors. It helps us understand their pain points, desired solutions, and willingness to pay. Through validation, we can identify the features customers value most and segment our target audience based on various characteristics. This information helps us to create customer-centric products, tailor marketing messages, and improve the overall user experience, ultimately leading to higher satisfaction and loyalty.