TL;DR

Financial service customers now expect seamless digital journeys, hyper-personalized support, and empathy at every interaction. Yet many banks and fintechs still struggle with silos, legacy systems, and balancing security with convenience.

The way forward is continuous research and a customer-centric culture that adapts to shifting needs. With the right tools, financial institutions can generate insights faster, refine products with confidence, and consistently deliver experiences that drive customer loyalty and long-term growth.

Nearly 72% of customers say personalization influences their choice of bank—but only 3% actually use the personalized tools banks provide. This gap signals a major opportunity.

Financial organizations that prioritize delivering a superior customer experience are poised for success.

In this article, we'll explore how customer expectations are changing and what you can do to deliver superior experiences that foster lasting customer relationships and drive a competitive advantage in the financial services industry.

Why is customer experience in financial services important?

Traditionally, financial institutions focused on differentiating themselves through the products and services they offered.

But in today's market, features and rates are quickly copied by competitors. What sets financial institutions apart is customer experience, the ability to deliver seamless, personalized services, and engaging interactions across every touchpoint, from onboarding to support.

A positive customer experience can help:

- Build customer trust through transparency in fee structures, accurate information, and secure transactions

- Improve customer retention by gathering customer feedback often, addressing any issues promptly, and ensuring accessibility to services

- Create competitive differentiation through personalized experiences, omnichannel interactions, and innovative product offerings

- Increase operational efficiency with new technologies like AI-powered chatbots or mobile banking apps that reduce wait times and operational costs

- Drive revenue growth as satisfied customers are more likely to opt for additional products or services, creating cross-selling or up-selling opportunities

- Uplift brand reputation through positive reviews and ratings, attracting more customers and partnerships that are crucial for long-term success and sustainability

Banks have transitioned much like software companies, focusing on refining and enhancing customer experience after overcoming initial technological challenges. Now, differentiation is less about execution and more about positioning, branding, and ensuring the offerings align with the right customer needs.

Benjamin Humphrey

CEO and co-founder of Dovetail

What do customers expect from their financial services experience?

Digital transformation and the entrance of new players into the market, like fintech companies and neo-banks, have disrupted the financial services sector—introducing more user-friendly versions of traditional financial products and raising the bar for customer experience.

Whether it's applying for a debit card, opening a savings account, or renewing coverage, customers expect a superior, frictionless, and personalized experience. However, only 21% of banking customers and 27% of wealth management customers state they're completely satisfied with the digital experience offered to them.

According to Benjamin Humphrey, CEO and co-founder of Dovetail, there's been a notable shift in the financial sector towards creating a more user-centric model.

While bank offerings remain largely the same, the emphasis on brand and user experience has grown.

Benjamin Humphrey

CEO and co-founder of Dovetail

Key customer experience trends shaping expectations

- Digital-first convenience: 88% of consumers prefer to bank online, either via mobile app (59%) or desktop browser (29%)

- Personalization: 93% want banks to “know me and my needs”, and 89% expect useful financial advice

- Experience over price: 73% say experience is a key factor in purchase decisions; companies with great CX can charge a 16% premium; 59% of customers will leave after several bad experiences, and 17% will leave after just one

- Human element: 82% of U.S. consumers and 74% of non-U.S. consumers want more human interaction in the future; 59% feel companies have lost touch with the human side of CX

- AI adoption boom: 78% of organizations now use AI in at least one business function, up from 55% in 2023

Key CX challenges in banking and fintech

Now that we've discussed what your customers expect, let's delve into the unique challenges the financial services industry faces in meeting these needs.

- Omnichannel consistency: Customers want seamless journeys whether they’re on mobile, web, in-branch, or calling support. But many organizations still struggle to unify these touchpoints into one coherent omnichannel experience.

Clients need to self-serve in their space and on their preferred devices. Know your client through research, dive into their data, and build solutions that engage them for the right reason at the right time in the right space.

Dylan Brits

Client Experience Designer at Capitec Bank

- Balancing security with convenience: Financial services deal with highly sensitive customer data. The challenge lies in protecting customer information without making everyday interactions feel cumbersome or frustrating.

- Legacy systems and technical debt: Outdated infrastructure makes it difficult to roll out modern, customer-friendly experiences at speed. Integrating new technologies often exposes system gaps.

- Organizational silos: Different product lines, departments, and teams often work in isolation, creating fragmented customer journeys and inconsistent service

More often than not, it's usually internal processes that hinder true innovation transformation. The bigger the organization gets, the harder it becomes to have visibility and transparency across different lines of business and different teams.

Sharanya Ravichandran

VP of Design at JPMorgan Chase

- Product and process complexity: Many offerings are still wrapped in jargon, long forms, and complicated terms—leaving customers confused and disengaged

- Responsible use of AI-driven tech and automation: As institutions adopt chatbots, automated fraud detection, and generative AI, they must ensure these systems are fair, explainable, and complemented by human support where needed

- Evolving regulatory pressures: Meeting strict compliance requirements while maintaining frictionless experiences is a delicate balancing act, particularly with open banking and data-sharing mandates

- Maintaining the human touch: Even with digital-first strategies and self-serve options, customers still expect empathy during sensitive moments like loan applications, claims, or financial hardship

Now, with these limitations in mind, let’s consider how you can go about improving the financial services experience for your customers.

6 Ways to improve customer experience in financial services

Improving customer experience is about deep-diving into all aspects of your products and services and tuning them to the needs of your customers. Here are six actionable initiatives you can focus on to ensure a solid CX strategy that meets—and even exceeds—your customer's expectations.

1. Get to know your customers

Digital transformation should always start and end with the customer.

Sharanya Ravichandran

VP of Design at JPMorgan Chase

Understanding your customers is crucial for successful customer experience optimization. Product development within financial services—and any industry, for that matter—should never be based on what you think customers want.

With generative research, you can develop a deeper understanding of your customers' motivations, pain points, and expectations. This helps you identify the right problem you want to solve and gather the evidence needed to move forward confidently.

2. Visualize the end-to-end customer journey

Map out every touchpoint your customers interact with—from the moment they become aware of your platform to when they either complete a transaction or choose to exit. By mapping out the customer journey, you can get a holistic view of the entire customer experience with your services and products and see what you need to optimize.

This is an ongoing effort that requires cross-functional collaboration, collecting customer input, and the willingness to adapt based on insights gained.

Here's how you can go about it:

- Identify customer touchpoints like website, mobile app, contact centers, branches, and more

- Capture feedback through surveys, social media, or interviews to see how customers feel about their interactions with your business

- Use analytics tools to get data like common drop-off points or stages where customers face issues

- Create customer personas and group your audience based on behavior patterns, goals, and attitudes

- Continuously monitor customer interactions and feedback to understand their evolving needs and concerns

3. Build a customer-centric culture

Customer-centricity puts the customer at the heart of every decision, strategy, and interaction. Involving customers continuously throughout the product development process leads to better experiences optimized with customers' wants, needs, and goals in mind.

UX research creates better solutions, better solutions create better wins, and better wins create better team cohesion.

Dylan Brits

Client Experience Designer at Capitec Bank

Plus, it's not just the customer experience that benefits from a customer-centric approach. The 2023 Research Maturity Report shows that companies that leverage research at their highest potential achieve 2.3 times better business outcomes than those with low-maturity practices. These include 4.3X faster time-to-market, 4.2X increased revenue, and 3X improved brand perception.

Here are some best practices for building a customer-centric culture:

- Educate and involve key stakeholders: Explain the importance of a customer-centric approach and share examples of how it improves customer satisfaction and business success

- Embed UX research into your processes: Conduct evaluative and generative research throughout the product lifecycle to ensure you continuously meet customer needs

- Make evidence-based decisions: Build a knowledge management hub for all research reports and learnings to ensure you base decisions on customer feedback and data

4. Provide a highly personalized experience

The transition from in-person to online banking and digital payment methods demands a fresh approach to delivering personalized experiences that build trust, enhance satisfaction, and foster long-term relationships.

Here are some strategies to consider:

- Prescriptive personalization: Leverage historical data, algorithms, and predictive analytics to offer personalized recommendations or actions, like an investment strategy based on customers' financial goals, risk tolerance, and the current economic environment

- Real-time personalization: Instantly deliver customized content to individual customers in response to their interactions with your brand, driving engagement and conversions

- Machine-learning personalization: ML algorithms analyze large and complex datasets to identify trends, allowing you to automate decision-making based on individual customer behaviors

5. Leverage emerging technologies

The digital landscape is fast-paced and ever-changing, and providing an optimized customer experience requires that you stay up-to-date with the latest technologies and CX trends.

In the 2023 CIO Agenda Report, Gartner found that 21% of enterprise businesses within the banking and investment industry consider improving the user experience their top priority—and plan to increase funding for total experience solutions from 35% to 42% in 2023.

According to the report, artificial intelligence (AI) is the technology most likely to be implemented by 2025, followed by distributed cloud and machine learning operations.

6. Foster continuous research to optimize experiences

Continuous research provides valuable insights into customer behaviors and expectations across all customer journey stages. This data can be used to further refine the onboarding process, simplify transactions, and encourage positive referrals.

Here's how you can adopt a continuous research mindset:

- Run product discovery to uncover your customers' wants and needs in order to validate ideas and inform your product strategy

- Collect feedback by running surveys or interview studies to continuously generate customer insights and plan future research and development

- Use analytics tools to identify actionable insights like common pain points or areas of improvement

- Conduct evaluative research—like usability testing, tree testing, and A/B testing—to learn how users interact with your product, identify pain points, and optimize the user experience

- Encourage collaboration across Marketing, Sales, Customer Support, and Product Development teams for shared learning and insights

📖 Explore real-life examples:

Learn how Bpifrance used Maze to increase research efficiency, halve time-to-insight, and improve their product designs based on user feedback. Read the case study now.

How Maze improves customer experience in banking and fintech

Improving customer experiences isn't a one-off task but a continuous journey. It's about tuning into your customers' needs and meeting them with data-driven quality and excellence at every touchpoint.

With a continuous product discovery tool like Maze, you can create intuitive, user-friendly experiences that resonate with your customers.

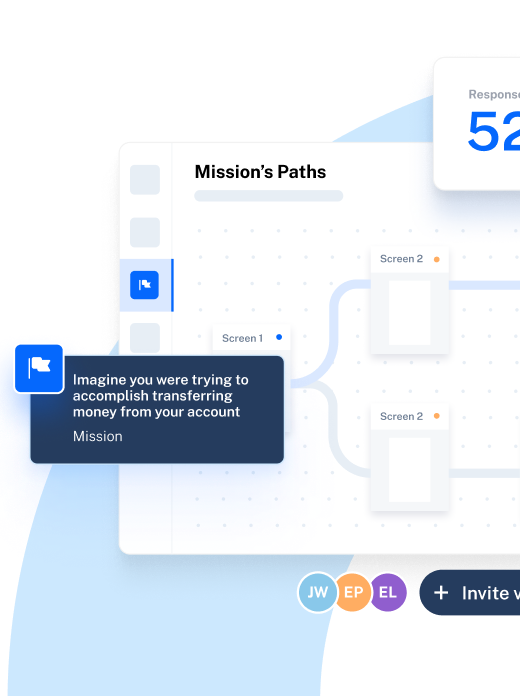

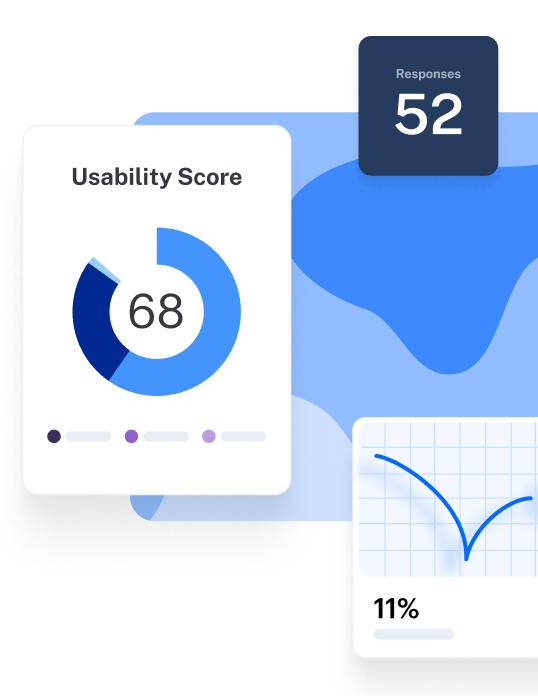

- Run expert-level research using a breadth of methods, including Prototype Testing, Interview Studies, and Website Testing—all in one platform

- Recruit from a diverse panel of participants and collect high-quality responses to shape and speed up your decision-making

- Simplify complex financial product research and gather insights while staying fully compliant

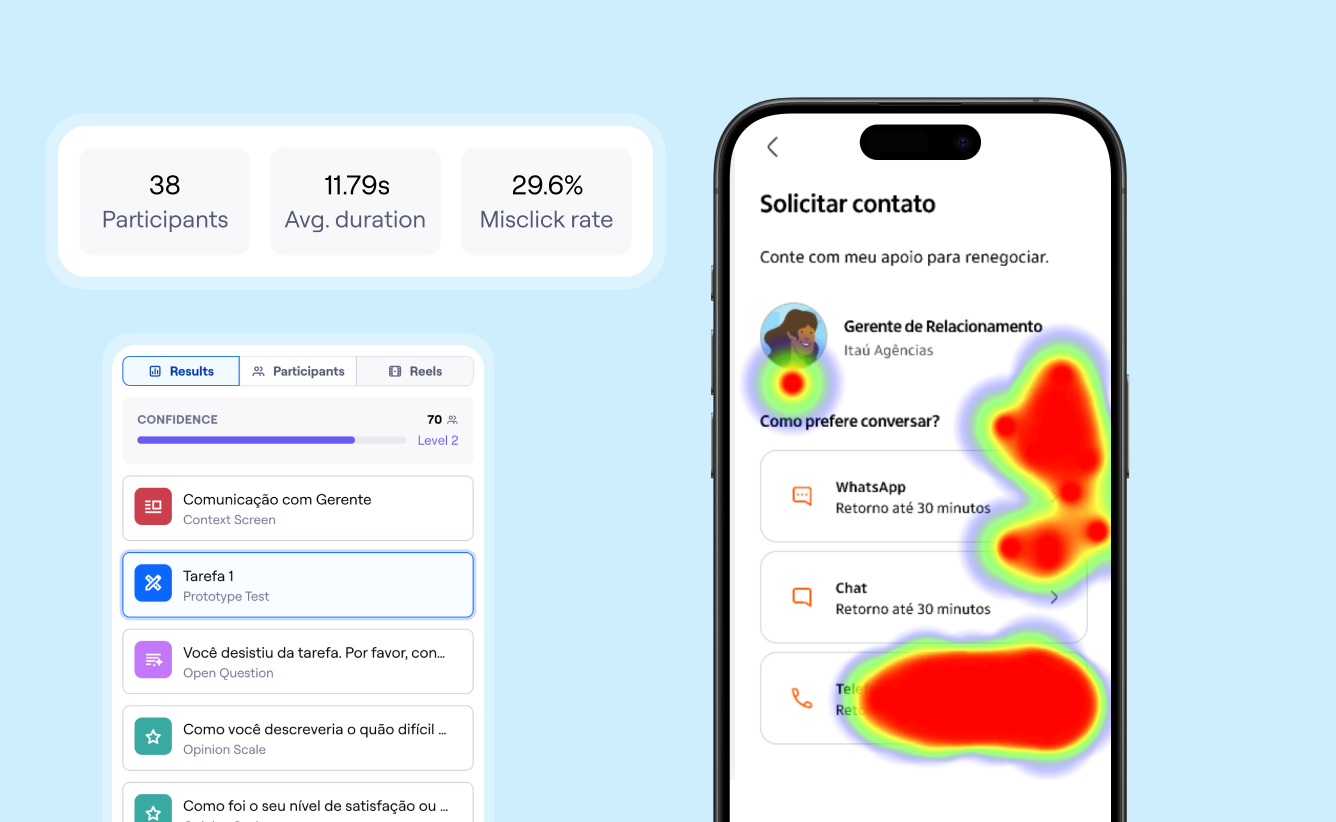

For example, Itaú Unibanco partnered with Maze to scale their usability testing. As one of Latin America’s largest banks, they needed a faster, more reliable way to validate hundreds of digital products for millions of customers.

By shifting to Maze, Itaú:

- Expanded their testing from dozens to hundreds of studies per year

- Achieved 3x faster time-to-insight, reducing research cycles from weeks to days

- Increased sample sizes 10x for more reliable results

- Empowered 300+ team members to run research independently

We run around 500 usability tests annually, and this volume is only possible with Maze. With our previous testing methods, achieving this scale would have been impossible.

Leonardo Aragão

Lead UX Researcher @ Itaú Unibanco

Financial services customers are demanding more from their customer experience, and they're switching when they're dissatisfied. The future of finance is here—make sure your financial services company isn't left behind.

Frequently asked questions about customer experience in financial services

What are the 3 E’s of customer experience?

What are the 3 E’s of customer experience?

The 3 E’s are effectiveness, ease, and emotion. In practice, this means helping customers achieve their goals (effectiveness), making interactions simple and seamless (ease), and leaving them with a positive, valued feeling (emotion).

How can financial services improve customer experience?

How can financial services improve customer experience?

Financial services can improve customer experience by:

- Fostering a customer-centric culture that puts customers at the heart of every decision and process

- Understanding the customer's financial journey, collecting feedback, and using insights to enhance the experience

- Using data analytics to tailor services and interactions to individual customer preferences and needs

- Rewarding loyal customers with incentives to increase satisfaction and retention

What are examples of customer experience in banking?

What are examples of customer experience in banking?

Some examples of great banking customer experience are:

- Including chatbots for a self-service, personalized experience—like Erica, Bank of America’s app-based chatbot

- Implementing appointment scheduling technology to reduce wait times and improve service—like Rogue Credit Union's appointment scheduling feature

- Addressing customers' unique banking needs and help them achieve their goals—like JPMorgan Chase's banking client experiences